Run a paid community through MemberSpace

As you begin building your membership business, you’ll find that you start to attract a community of engaged and excited people, all interested in what

In the world of venture capital, there are a lot of acronyms and terms that can be confusing for those who are not in the industry. One of these terms is COCR, or “cash-on-cash return.”

Cash-on-cash is important for venture capitalists because it measures how successful their investments are.

In this blog post, we will break down what cash-on-cash return is and how it impacts venture capitalists.

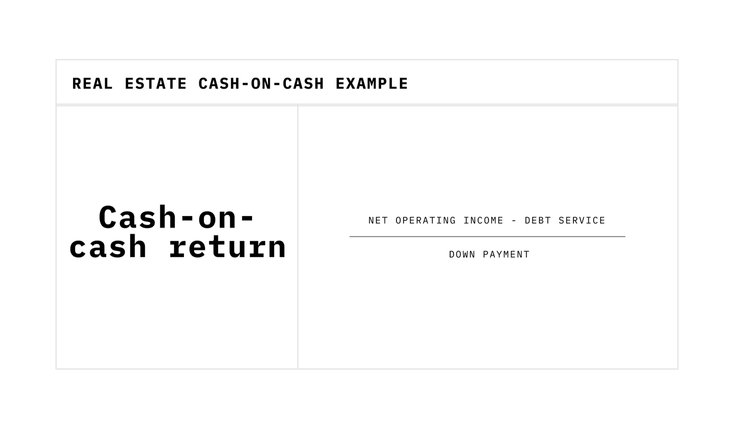

Cash on cash is a metric used by most investors, most notably real estate investors. This metric guides them through their decision-making process so they can understand if the projected net cash flow from a rental property justifies the initial investment into it.

Let’s use a quick real estate example to set the stage.

Let’s say a real estate investor purchases a rental property for $100,000 and his net cash flow after all expenses is $12,000. This means your COCR would be 12%. Not bad compared to some other places where you could park your money.

Real estate investors are also investing in assets, so the cash-on-cash return doesn’t matter for them as much as the overall property value rising over time.

This appreciation plus the monthly rent should give the investor a good return on their investment.

Like other investment funds, venture capitalists use many different acronyms to show (or hide) how well their fund is performing.

Maybe you’ve heard of IRR (internal rate of return), TVPI (total value to paid-in capital), ROI (return on investment), or MOIC (money on invested capital). All of these are slicing up the same thing, and that is how much money the fund has made for their limited partners.

Cash on cash is a more simple way to show that number (we’ll get into the calculation below), and it helps LPs understand how effectively their dollars are being managed by the fund.

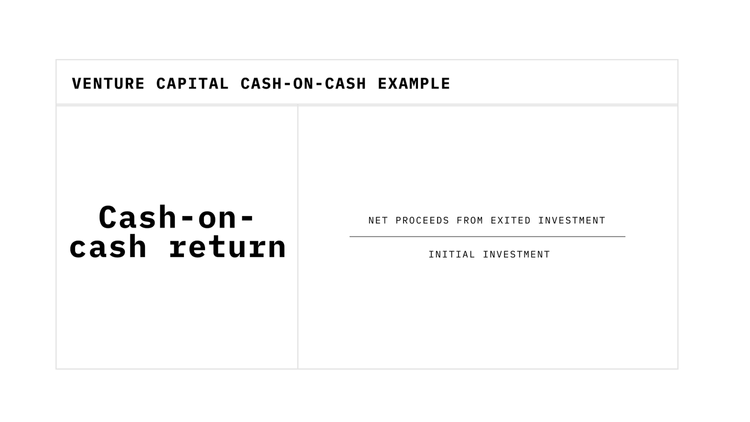

Cash-on-cash return (COCR) is the annual cash flow that an investor receives from their investment, divided by the amount of money invested.

In real estate, this number is calculated on an annual basis rather than over the entire holding period of the fund. In venture capital, this number is usually calculated at the end of the reporting period since VCs are not receiving distributions from their investment until it exits through an IPO or M&A.

In real estate, cash-on cash is primarily used as a forecasting tool so that investors can project earnings and expenses for a project or company.

In venture capital, cash-on-cash is usually calculated at the end of a fund lifecycle. It is used as a lagging indicator to show how well the fund deployed capital, and it is used as marketing material to help the general partners pitch limited partners to raise their next fund.

Cash-on-cash is more popular in the real estate world, but you can see why it’s also used by venture capitalists.

In real estate, the calculation factors in many things that aren’t variables within venture capital. Things like annual pre-tax cash flow, interest payments, vacancy rate, operating expenses, and annual mortgage payments make this a more complex formula for real estate investors.

Since VCs do not need to factor in any of these things, it’s much easier for them to get an idea of whether or not their down payment (in this case an investment into equity of a company) turns into actual cash (through a liquidation event).

Short answer: it depends.

Cash-on-cash return and ROI (return on investment) are not the same when debt is used. This is more typical in the real estate world, but also applies to venture debt funds as well.

ROI calculates the total return, including the debt burden, for an investment.

Cash-on-cash return, on the other hand, only measures the return on the actual cash invested.

This gives a more accurate view to investors on how well they are able to turn a dollar into two.

Cash-on-cash and internal rate of return (IRR) are two different measures of investment performance.

The biggest difference when comparing cash-on-cash and IRR is that the cash-on-cash calculation only takes into account cash flow from a single year, whereas the IRR takes into account all cash flows during the entire holding period. Understanding this difference, investors can model out which route is right for them based on their investment objectives.

Using the above example about a real estate investment, it likely makes more sense for this investor to model out returns on a cash-on-cash basis.

Real estate investors have the headache of having to worry about debt service, and they are expected to use rental properties to generate monthly rental income in order to handle that debt service. If they aren’t able to find renters and generate monthly cash flow, their cash-on-cash return will suffer.

Compare this model to a venture capital investor.

Venture capitalists invests in equity, and they don’t expect that equity to generate cash flow. Instead, they expect the value of their equity position to grow over time.

Since these equity positions are illiquid, venture capitalists do not make money until there is an exit event where the company is sold or goes public and the equity positions become liquid. As you can expect, this is a longer waiting period, and investors can sometimes wait a decade or more before they have anything to show for their investments.

In this scenario, it makes more sense for a venture capital firm to show their fund performance using IRR since that shows the rate of return over the entire lifecycle of the fund.

This all depends on the investor, and everybody seems to have a different benchmark for success.

Some investors are happy with a 10% return while others won’t invest unless you can model a 15% cash-on-cash return. When it comes to what is a good hurdle rate, it’s all relative.

In venture capital investing, there doesn’t seem to be a standard benchmark for cash-on-cash returns. Since venture capital relies less on consistent returns and more on outlier events, it’s harder to build any type of forward-looking financial analysis of what investors can expect to make over the lifecycle of an investment.

We’ve thrown a lot of information at you. Let’s walk through a quick example to tie things together.

Say you run a venture capital firm. You find a company you like, so you invest $1,000,000 of cash in exchange for 10% of the equity in that company. This would value the company at $10,000,000 ($1,000,000 / 10% = $10,000,000). This is purely an equity investment, and there is no equity dividend rate.

Now that you’re an investor in the company, you do what you can to help the company grow and to make your equity more valuable. You start introducing them to customers, helping with marketing, and doing whatever else you can to increase revenue and cut down on operating expenses.

Over the next five years, you keep doing work helping this company without any immediate cash coming your way. You’re playing the long game and making your equity more valuable so you can set yourself up with a larger payout in the future.

In year six, let’s say that company gets an acquisition offer and decides to accept it. The total purchase price is $100,000,000, and you still own 10% of the company.

Quick math tells you that your equity stake is worth $10,000,000 now, or a 10X cash-on-cash return.

As we’ve already discussed, a lot of different factors go into cash-on-cash returns. For venture capitalists, it’s a little easier to calculate.

To get a cash return formula, VCs need to know the total cash invested and the total cash return.

Compare this simple equation to real estate investing where you need to factor in capitalization rate, rent prices, the mortgage payment, vacancy rates, net operating income, property taxes, and expected holding period, and you can understand why there is more of an emphasis cash-on-cash in the real estate industry.

In venture capital, there are two ways to impact your cash-on-cash returns: buying at higher or lower valuations, and selling at higher or lower valuations.

In real estate, there are a lot more levers to pull, which explains why real estate operators are so valuable to their firms.

Regardless of industry, cash-on-cash is one of the most objective measures of investment performance. It shows how effective investors are in generating a cash return on their investment, and this demonstrates how good investors are at their jobs.

To recap, calculating cash-on-cash return within venture capital is a little different than other industries since VCs have a different investment style. They care less about consistent cash flow and more about lump sum payments.

Cash-on-cash is used by venture capital funds to show lagging indicators through prior investment performance (how well funds have done to-date). Cash-on-cash is used by real estate funds to model out future performance in order to justify investment into different properties.

Cash-on-cash is different than ROI since ROI considers debt required when calculating return whereas cash-on-cash only cares about the actual cash invested.

Cash-on-cash is also different than IRR since IRR factors cash flow over the entire life of the investment where cash-on-cash is an annual metric.

That wraps it up for us. Hopefully this article taught you something about evaluating cash-on-cash performance.

If you’re looking for more free resources on venture capital, make sure to check out our website or free weekly newsletter.

As you begin building your membership business, you’ll find that you start to attract a community of engaged and excited people, all interested in what

This post discusses community strategy: finding your why with 4 questions.

More information doesn’t equal more value. Millions of pieces of digital content are being pushed out every day through Twitter, YouTube, newsletters, blogs, TikTok, or

Your magnet should create demand. Your community should fulfill that demand. Communities are only valuable if they create a place of value exchange for people.