Venture capital is one of the most lucrative roles in finance. Talking to startup founders, earning equity into growth companies, and a better work-life balance are all things that pull people to work in VC.

There are a few things that are unclear about VC, and one of the biggest mysteries is pay.

How much do VCs make?

That’s what we set out to figure out.

Looking to hire your next investor from the #1 community of venture talent? Talk to our team to see if there is a fit.

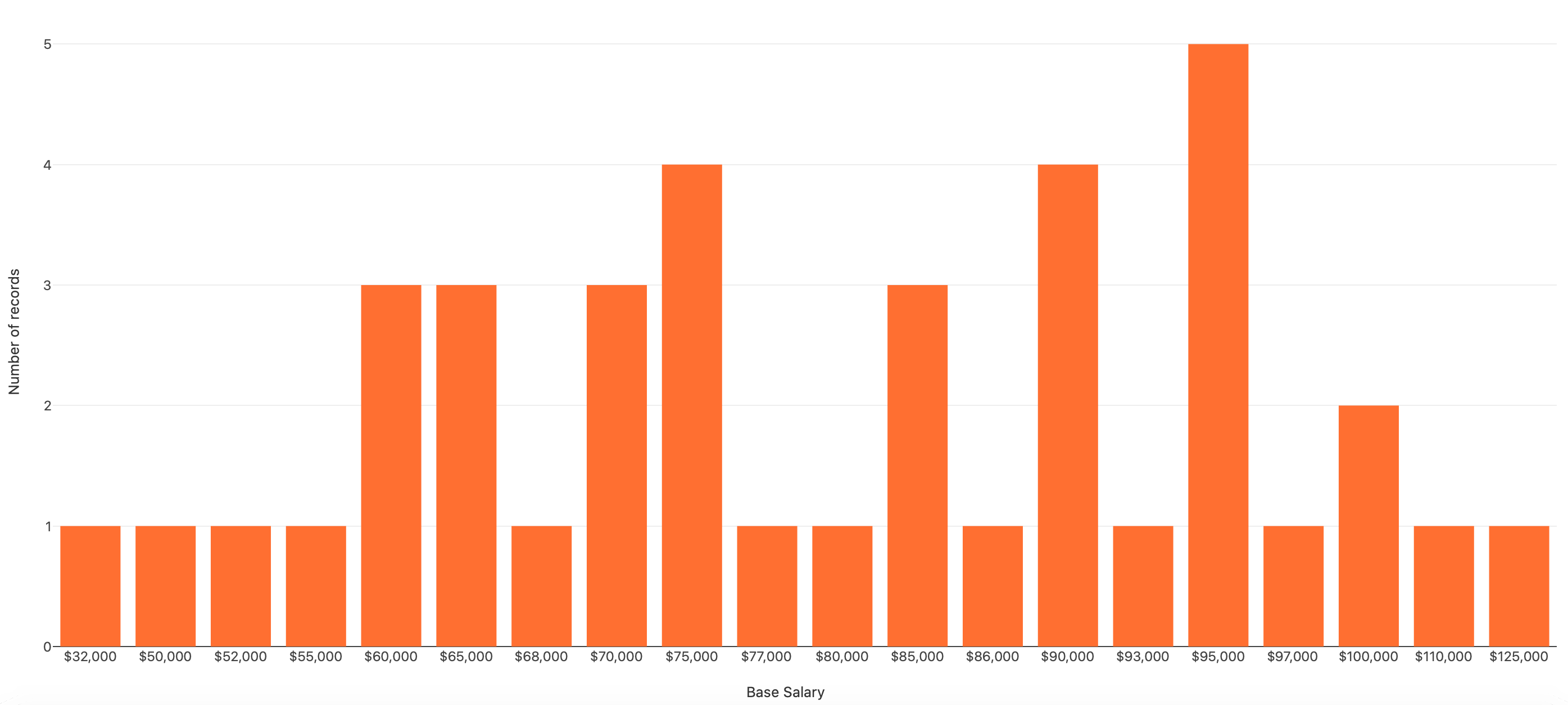

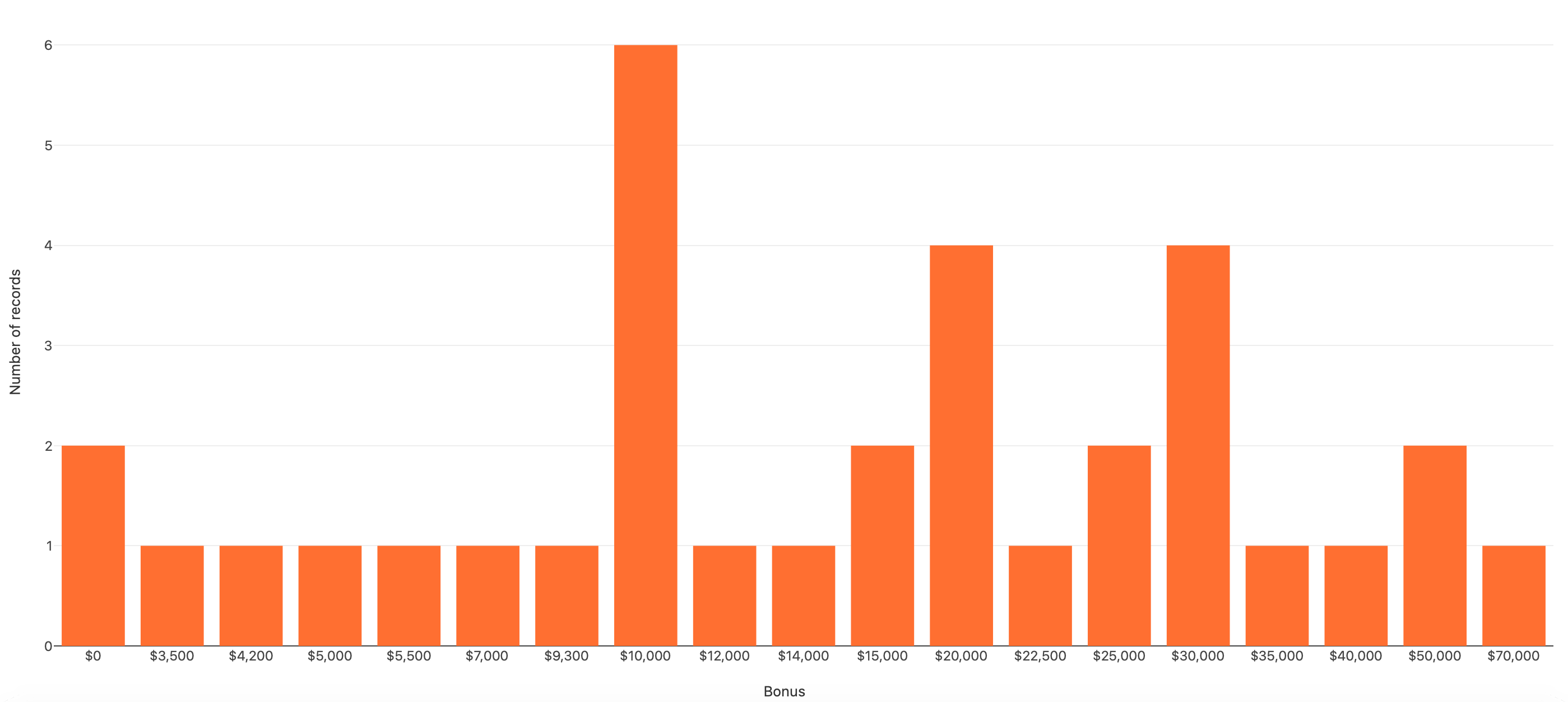

Here are the results from our last three years of Confluence.VC salary data. This data is meant to help you better negotiate salary offers in venture capital when the time comes.

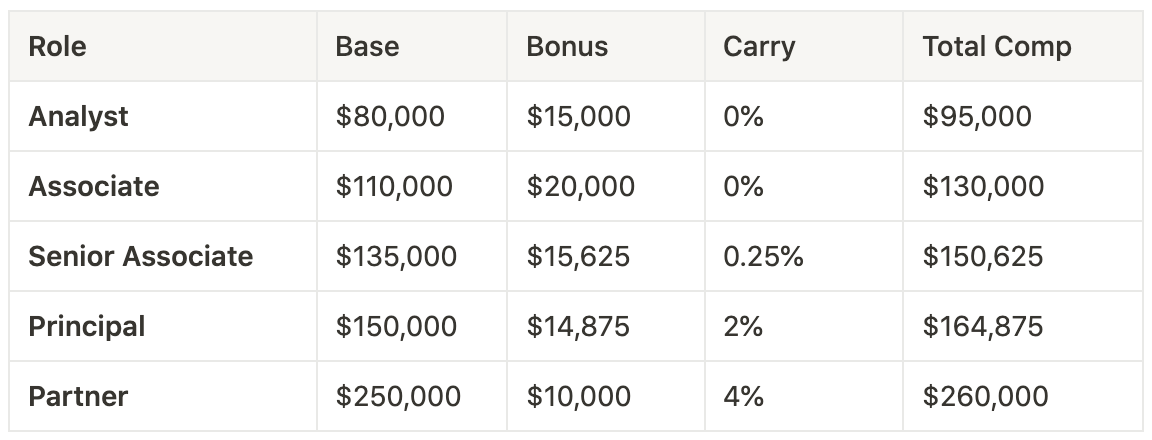

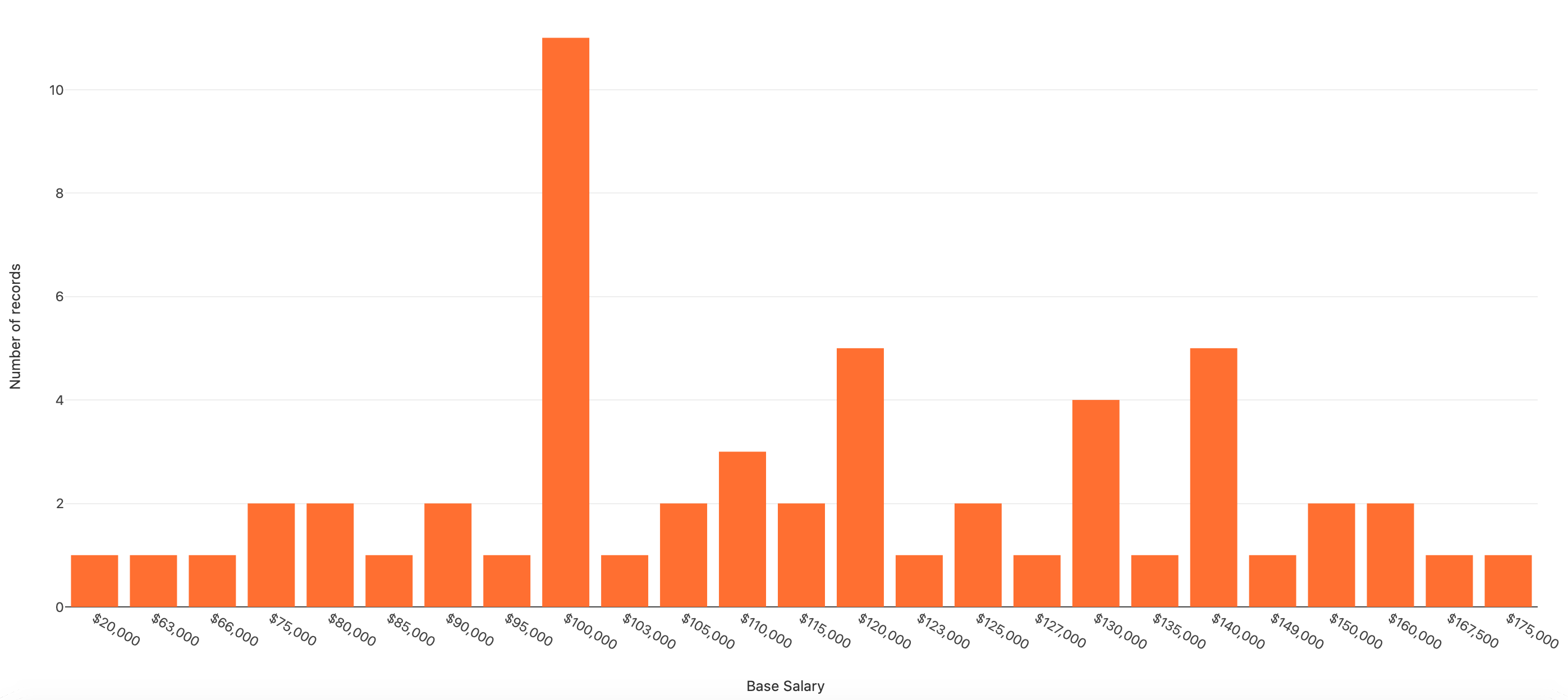

Here’s a summary venture capital salaries at various levels.

*The numbers below are the median from our survey results.

One thing to keep in mind as you go through these numbers is that VC notoriously does not follow a standardized hierarchy.

Some funds follow a flat structure with only partners and admin workers while others have a more hierarchical structure. Some firms combine principals and VPs. Others combine analysts and associates. Others name partners different things based on tenure.

For the sake of simplicity, here’s a generic structure we followed to make this report. We will ignore managing partners and general partners since most of their compensation is in the form of carry.

Analysts are at the bottom of the totem pole.

These employees usually come from another finance role like investment banking, or they are fresh out of undergrad. Their main priority is sourcing investments, and they are compensated mainly through salary and a cash bonus based off performance. Almost all analysts get no carry.

*N = 39

Associates are above analysts, but they have a similar set of priorities.

These employees also often come from another finance role like investment banking, or they have worked in another role in tech. Their main priority is sourcing investments, but they also start to get more responsibility through supporting companies after the check. They are compensated mainly through salary and a cash bonus based off performance. Most associates do not earn meaningful carry.

*N = 56

Senior associates have established themselves professionally, and they start to get more responsibility in their work.

Senior associates usually have an MBA or Master’s degree (over half of respondents have an advanced degree), and they are more seasoned workers. Like analysts and associates, sourcing is a huge portion of their work, but they also help with operations, fundraising, and supporting companies post-investment. They are compensated mainly through salary and a cash bonus based off performance. Most senior associates do not earn carry, but a small percentage do.

*N = 32

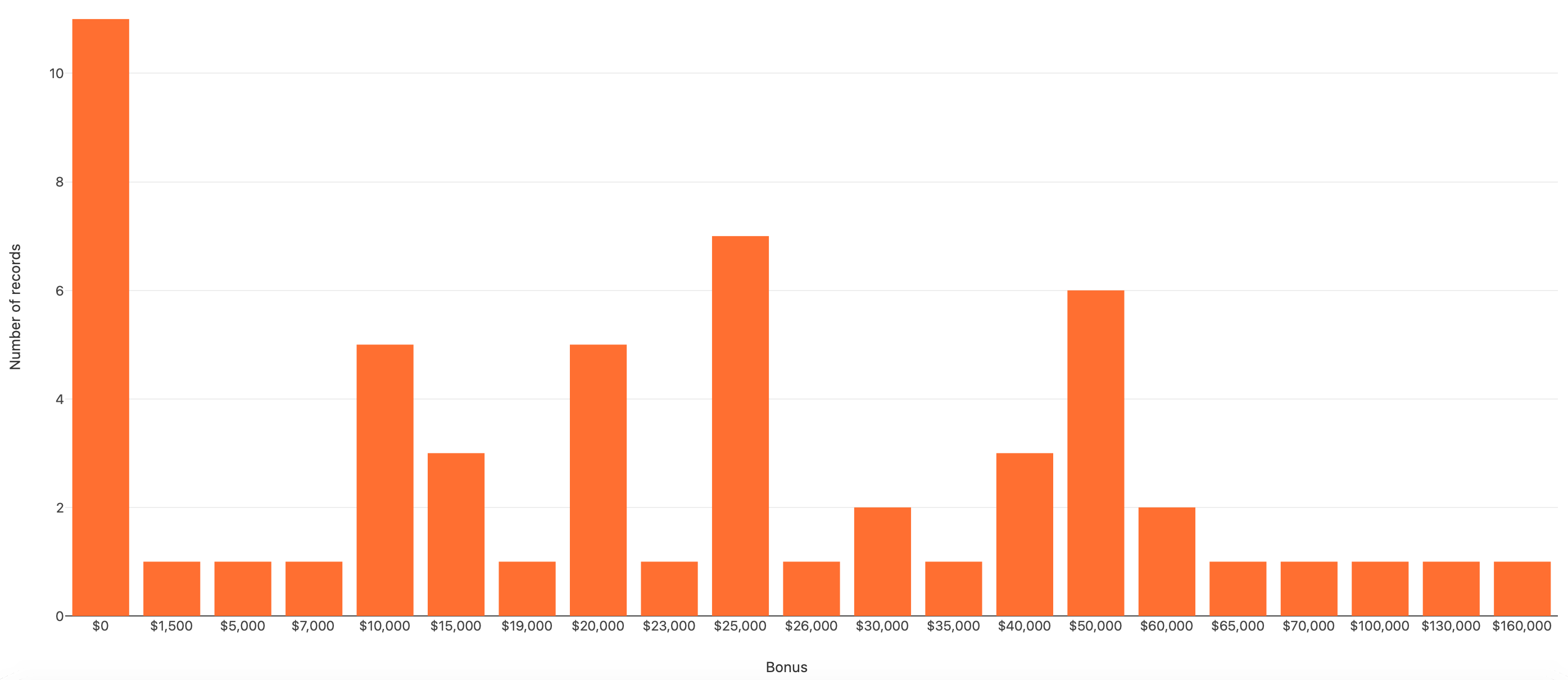

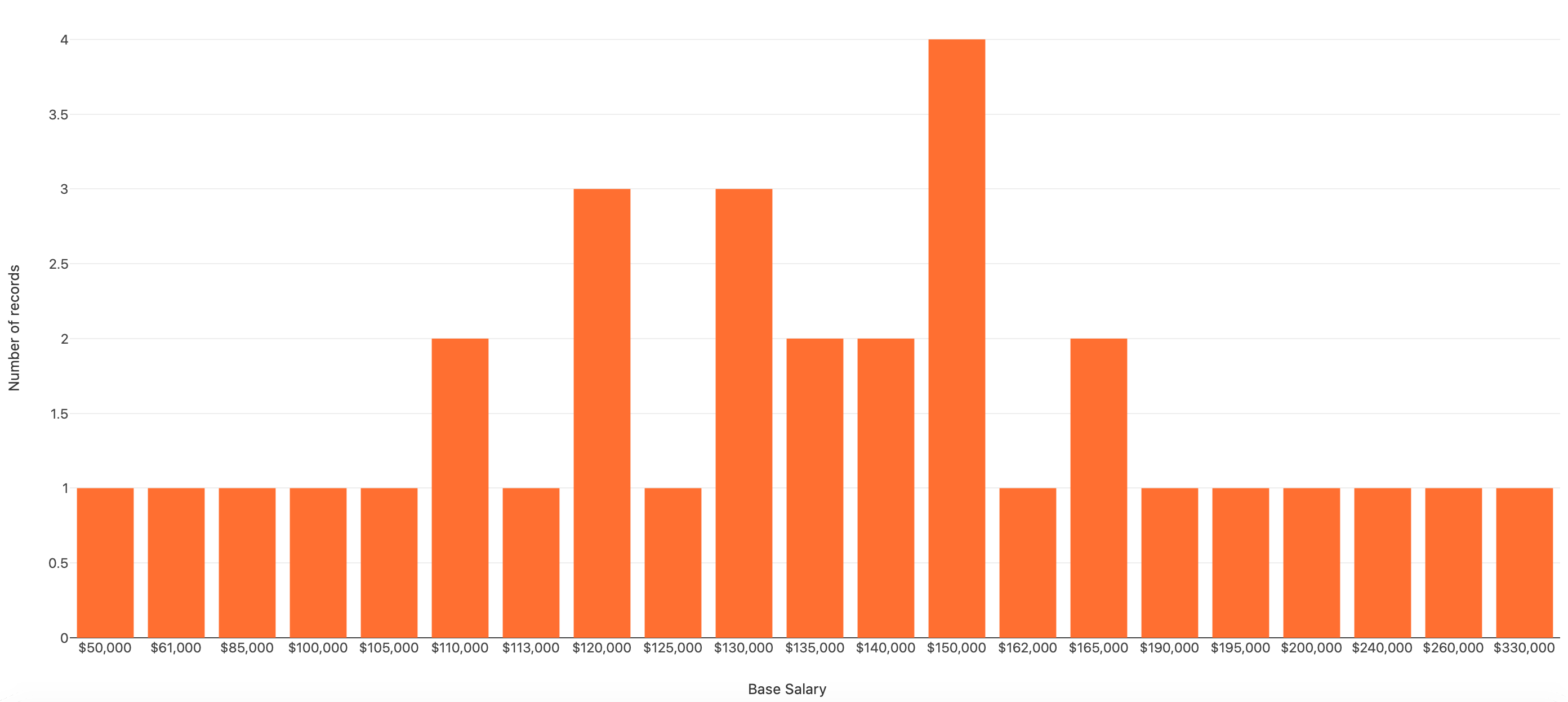

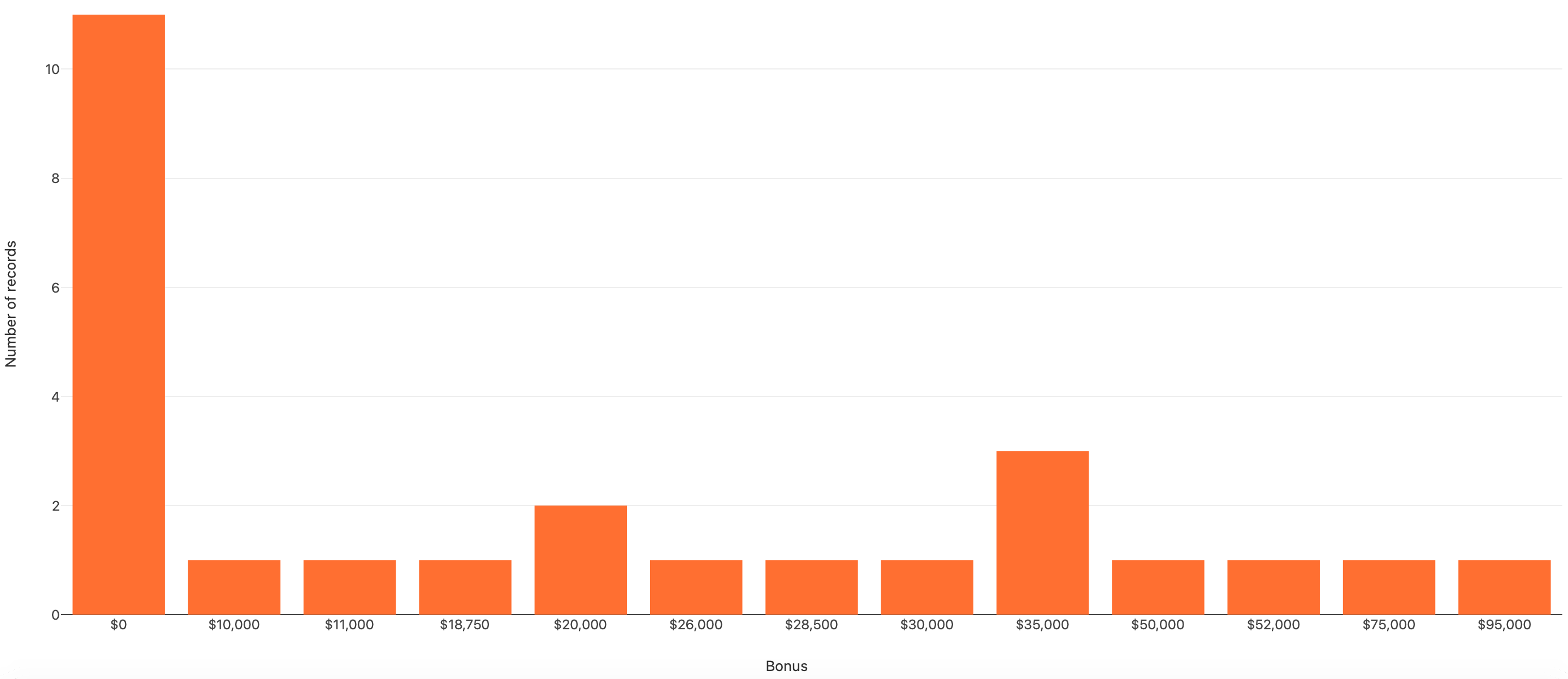

Principals have usually established themselves at a firm, and they are on track to become partner one day.

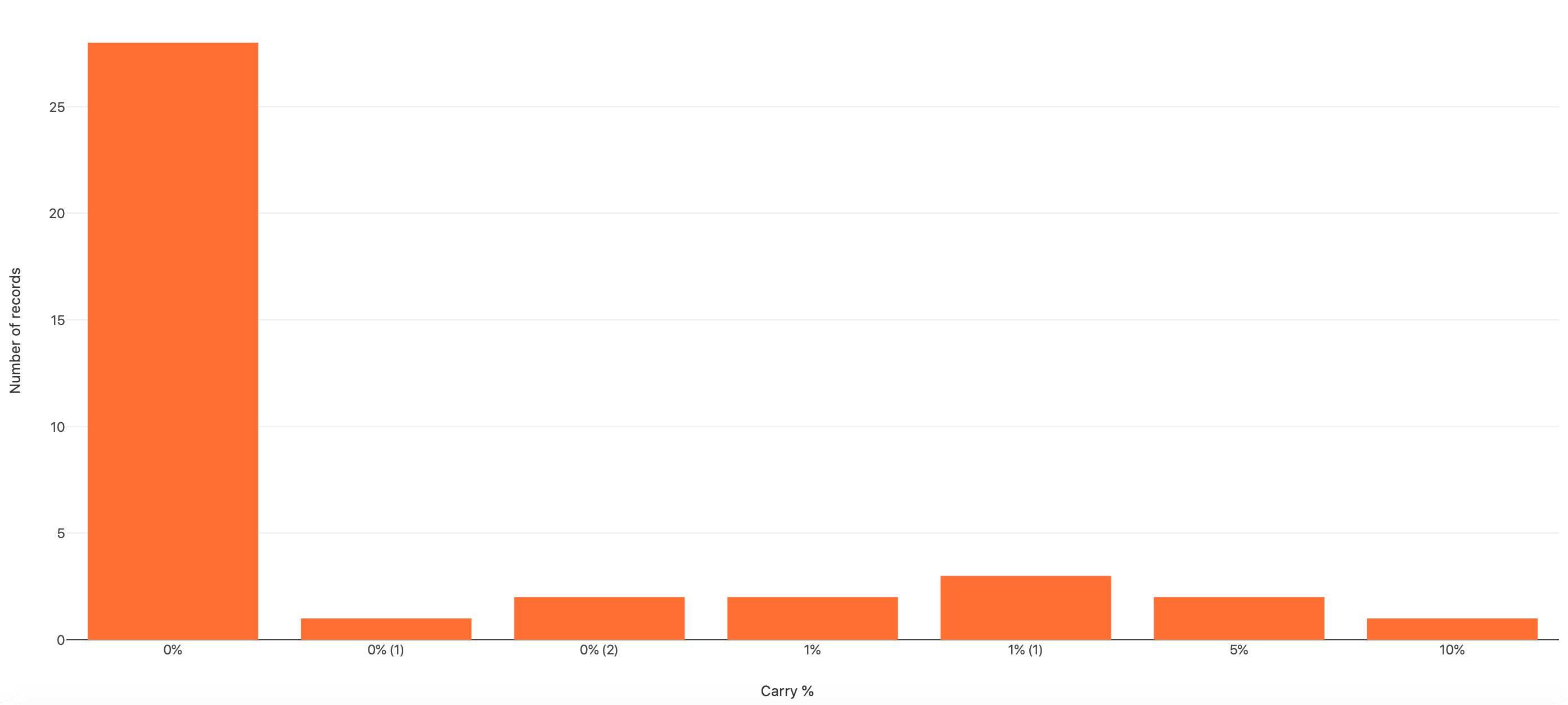

Similar to senior associates, 62% principals we surveyed have an MBA or Master’s degree. Principals are flexible with their work, and they help with sourcing, operations, fundraising, and supporting companies post-investment. They are compensated mainly through salary and a cash bonus based off performance. Many still don’t earn carry, many others start to share the funds’ profits.

*N = 26

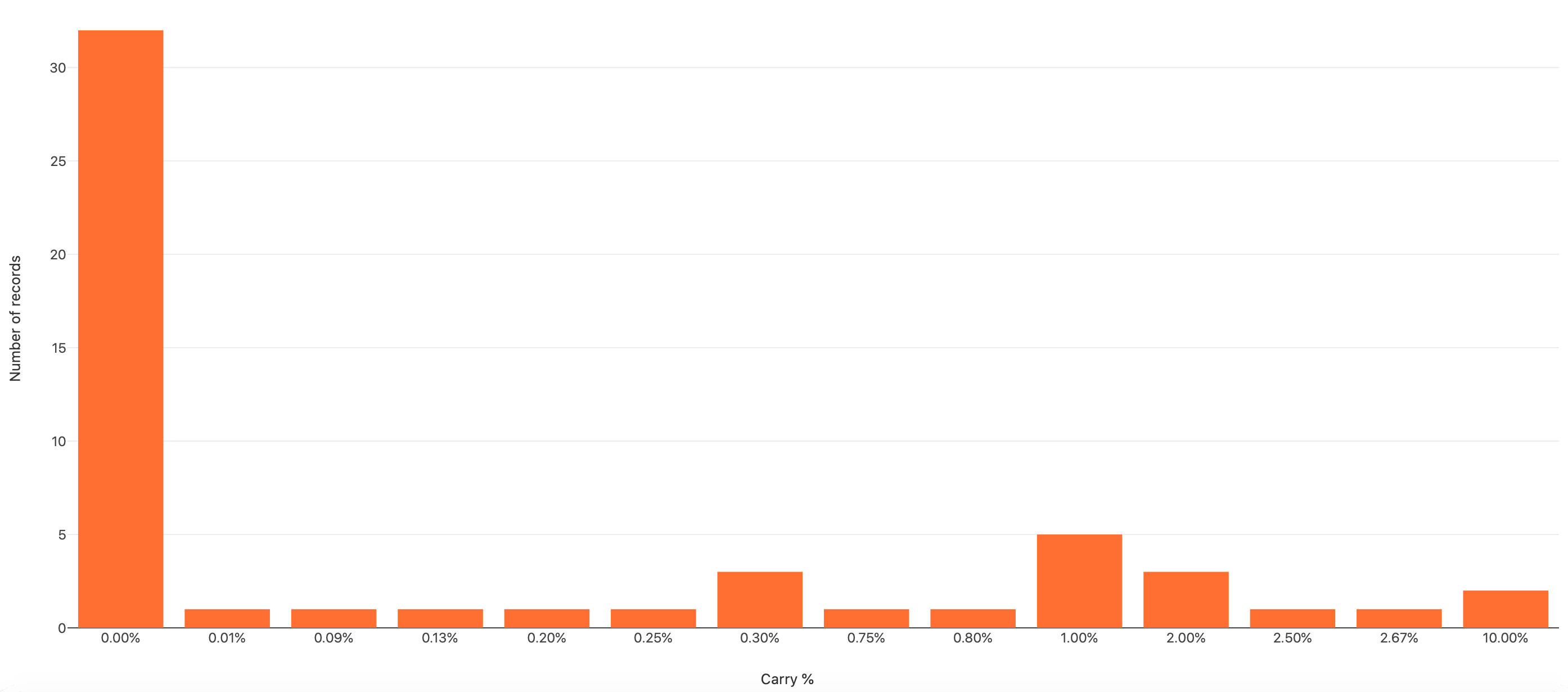

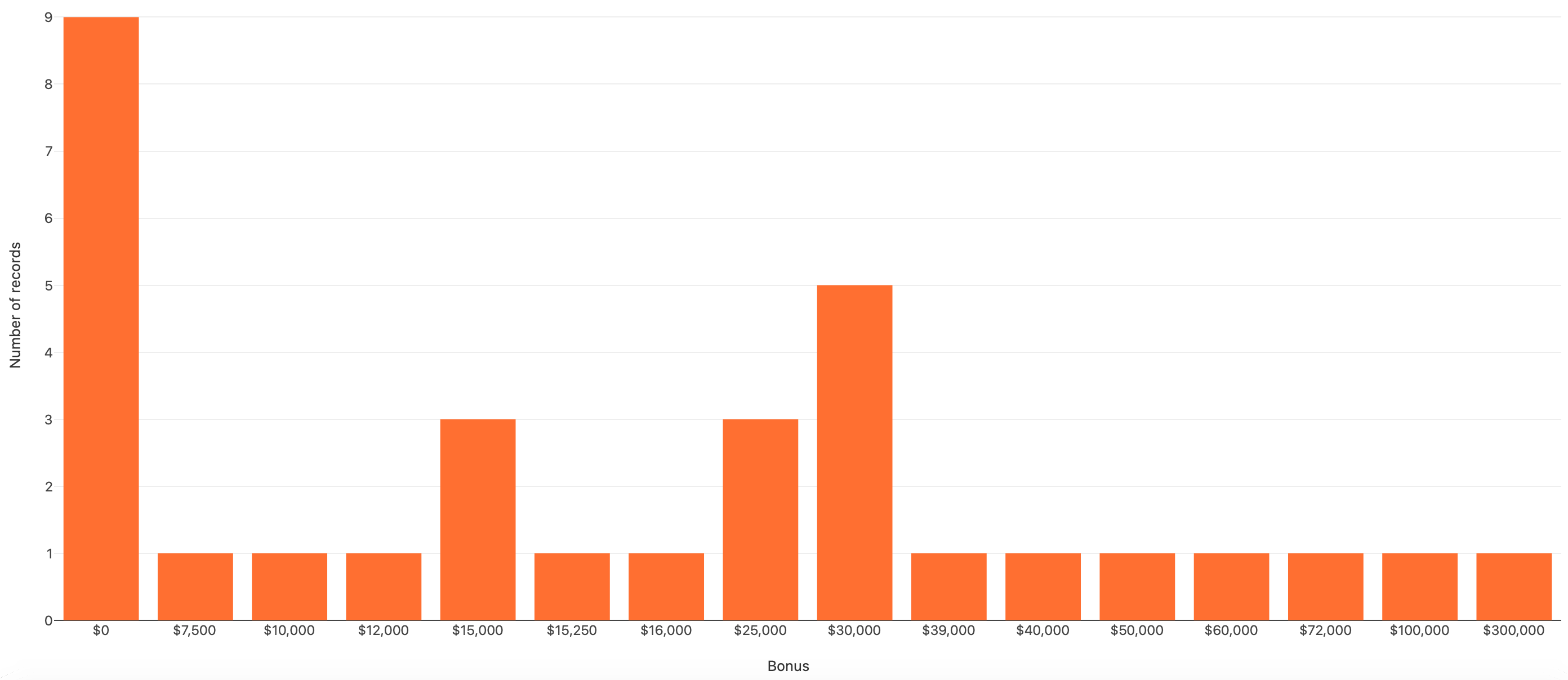

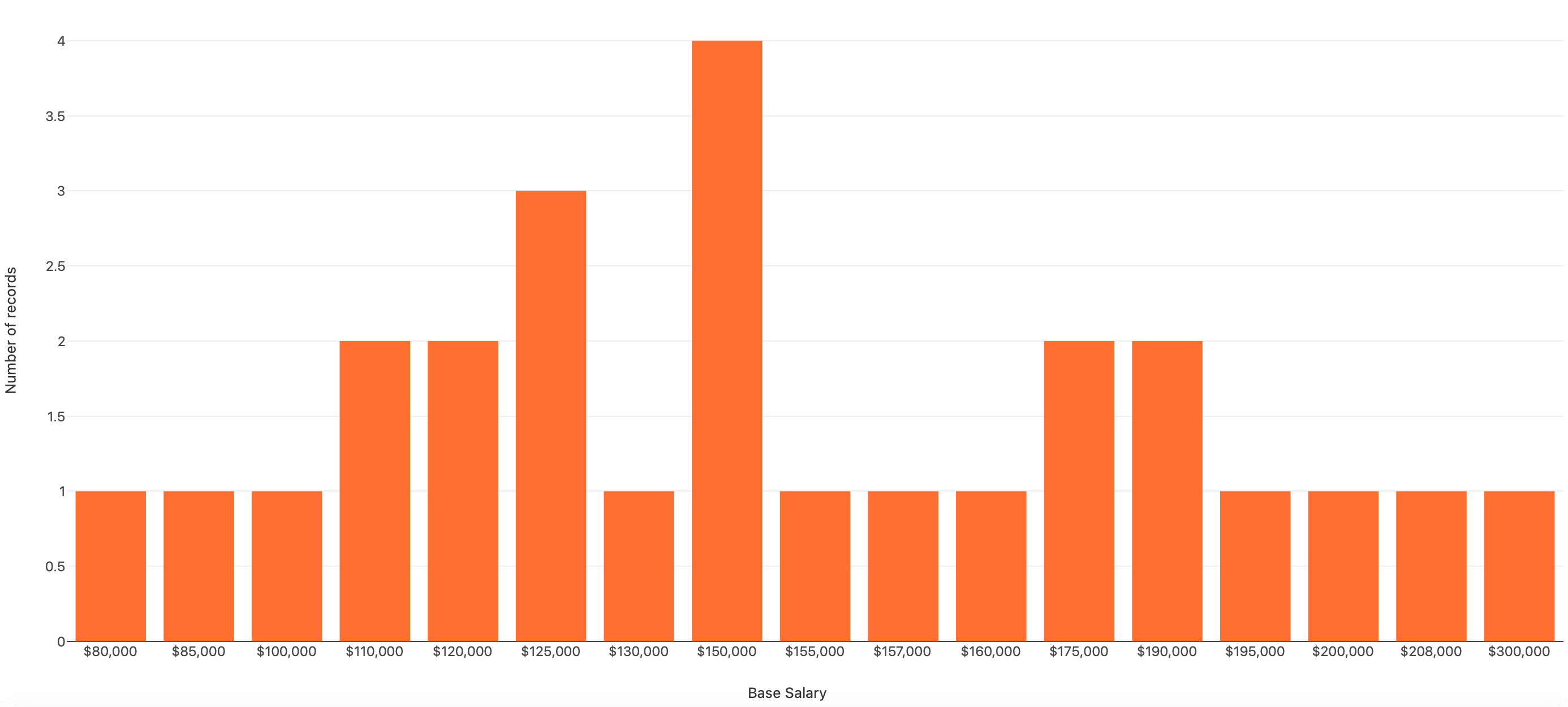

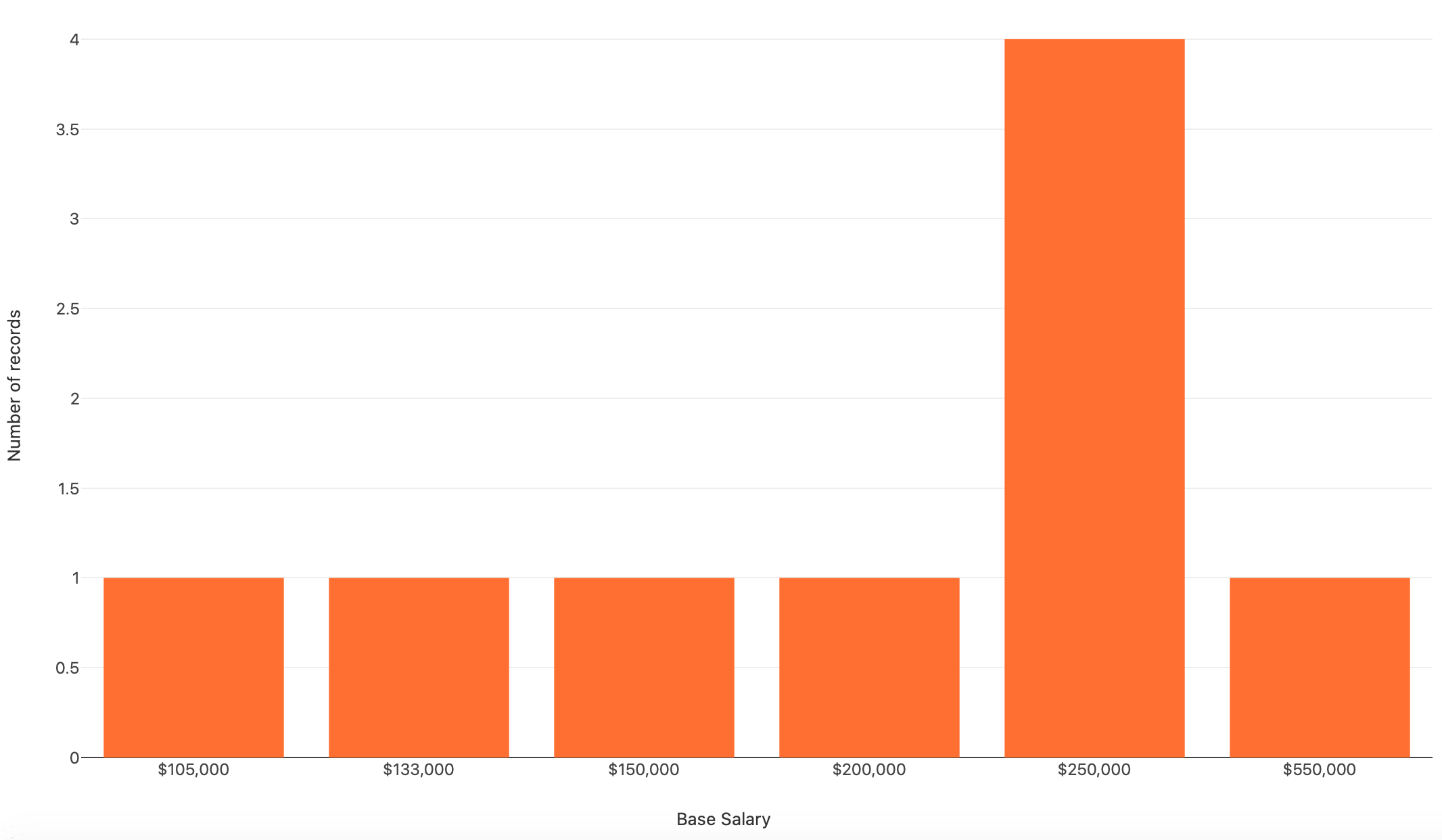

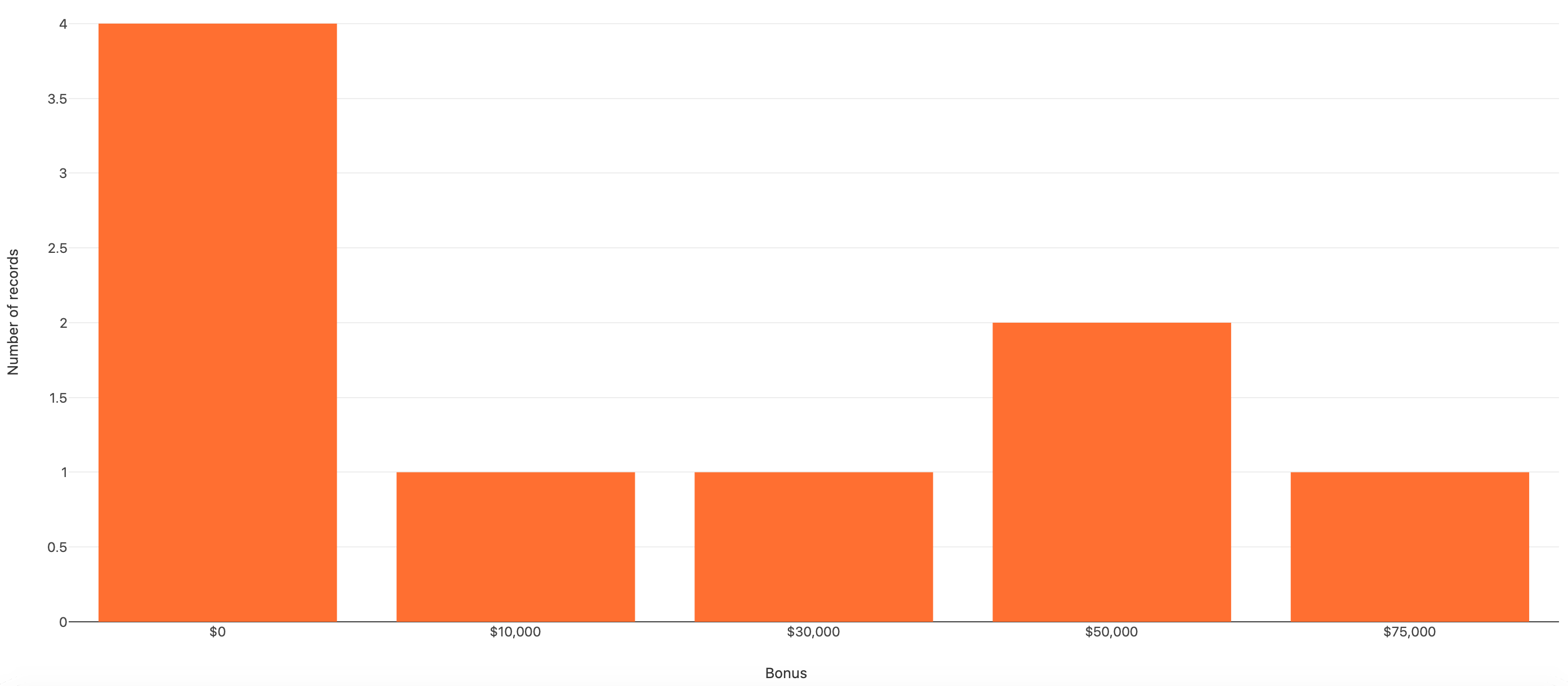

Partners are the name and face of the fund.

Following the trend of senior associates, and principals needing MBAs to advance in their career, we’d expect partners to need advanced degrees, but that doesn’t seem to be the case (two of our surveyed partners have PhDs; the others only had bachelor’s degrees). Sourcing is not as much of a focus for partners (that’s why you hire the roles shown earlier), and their main priority is fundraising. Partners are compensated through salary and bonus, and they are more likely to earn carried interest.

*N = 9

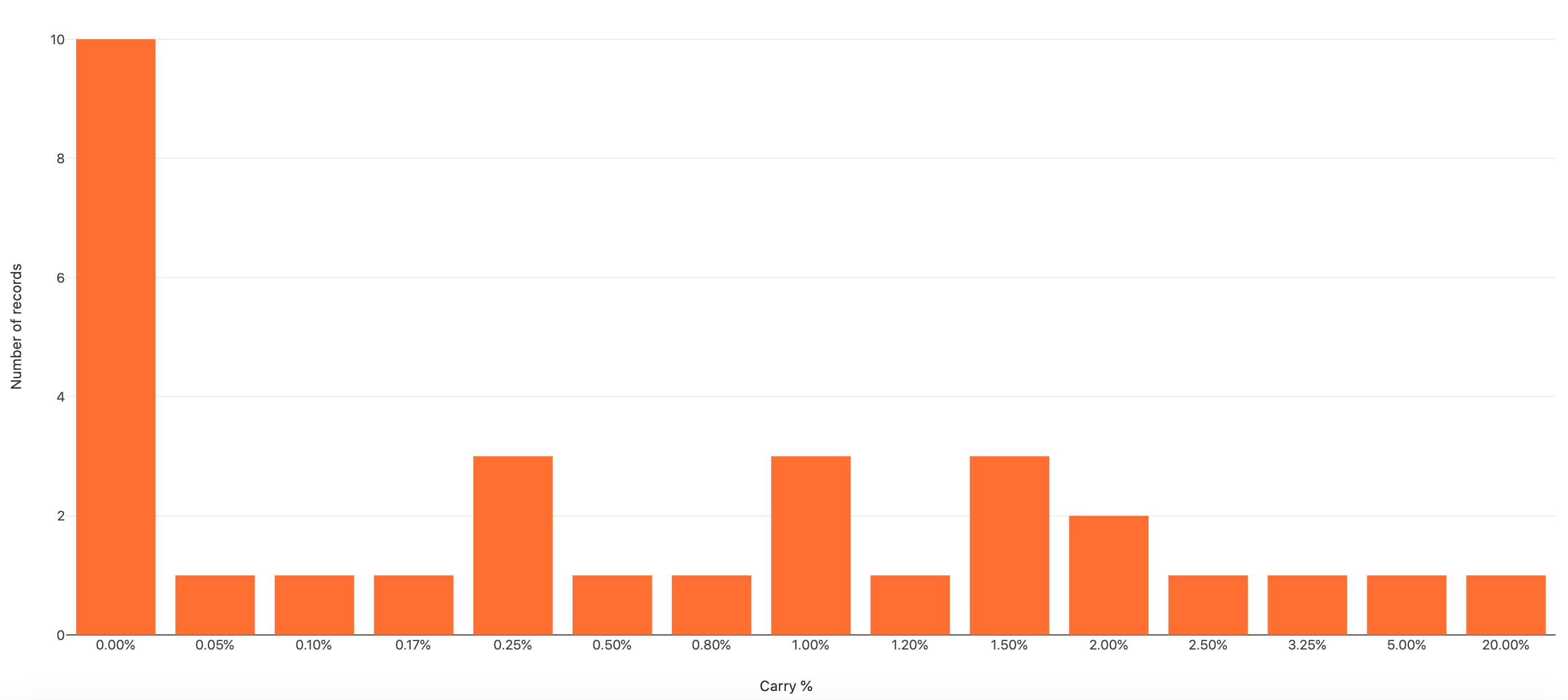

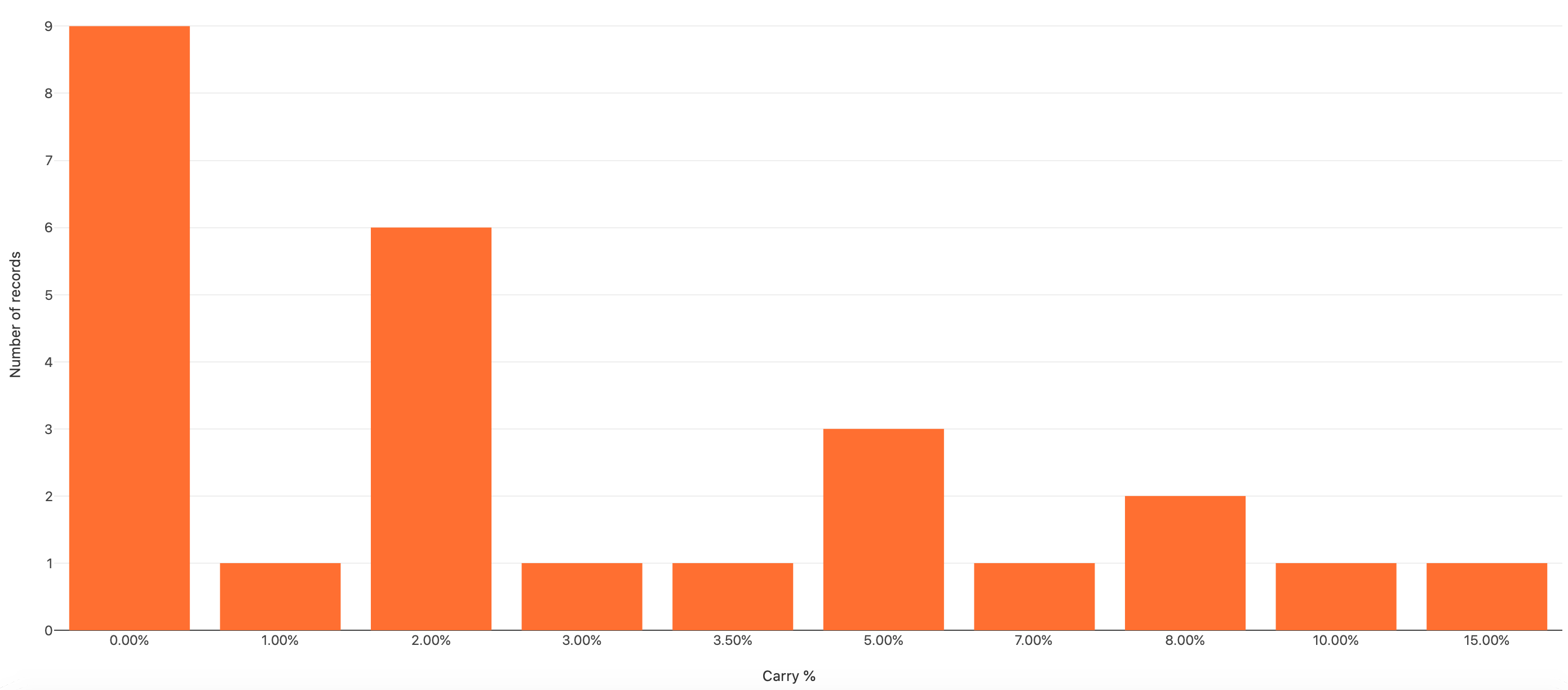

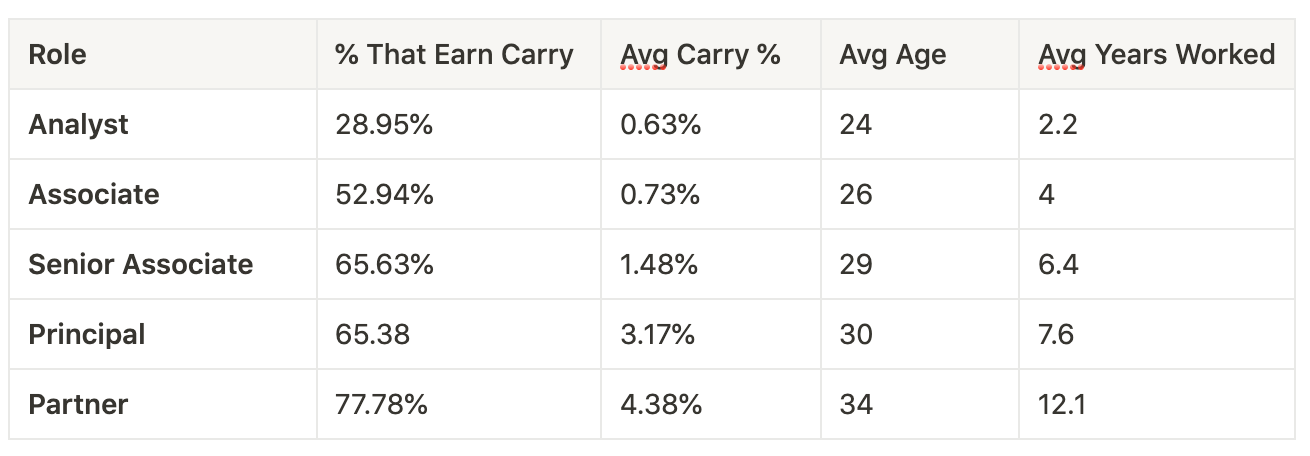

The average salary and bonus in venture capital makes it a well-paying job, but people work in VC for one thing more than that: carry.

Carried interest is the percentage of fund profits that goes towards the general partnership. This is usually 20%, and this 20% is split up between those that helped the fund generate those profits.

As you can see in the results above, “those that helped the fund generate those profits” is often defined as principals and partners and not those below on the pecking order.

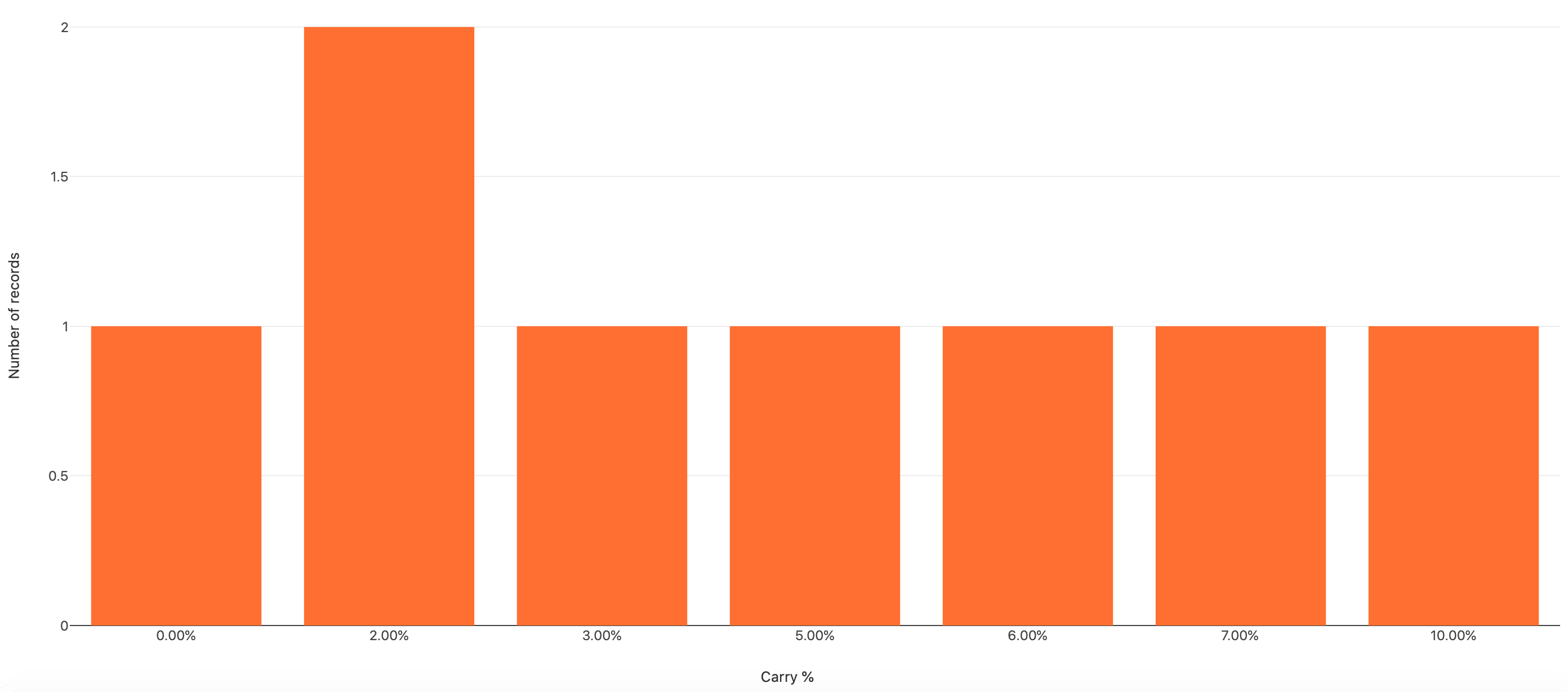

Of the 184 respondents of our survey, 94 of them received zero carried interest, and 139 out of 184 (75.54%) receive less than 2% of carry.

Even as you progress to principal and partner, earning carry is not promised.

Venture capital is a lucrative field to work in for a number of reasons.

You get to talk to interesting founders solving hard problems, invest in high-growth companies, and your hours are much more relaxed than other finance or private equity roles. Speaking or private equity, if you’re interested in finding out similar information, like private equity compensation structure and salary, take a look at Heidrick and Struggles’ private equity compensation survey and report.

So, on top of previously mentioned benefits of working in the venture capital sphere, VCs have good compensation structures, and you can expect to make good money if you break in.

The salaries in venture capital are one thing but earning carried interest is what most VCs are chasing, and it takes years to earn this if you plan on working your way up from analyst to partner. John Gannon’s vc salary data is another source for you to look at the numbers.

You may also want to take a look at our list of investors based on city, state, sector, stage and type. It’s all right there for you.

Thanks for reading this far. We share VC insights like this every week in our newsletter. Subscribe below to not miss out on the next one.