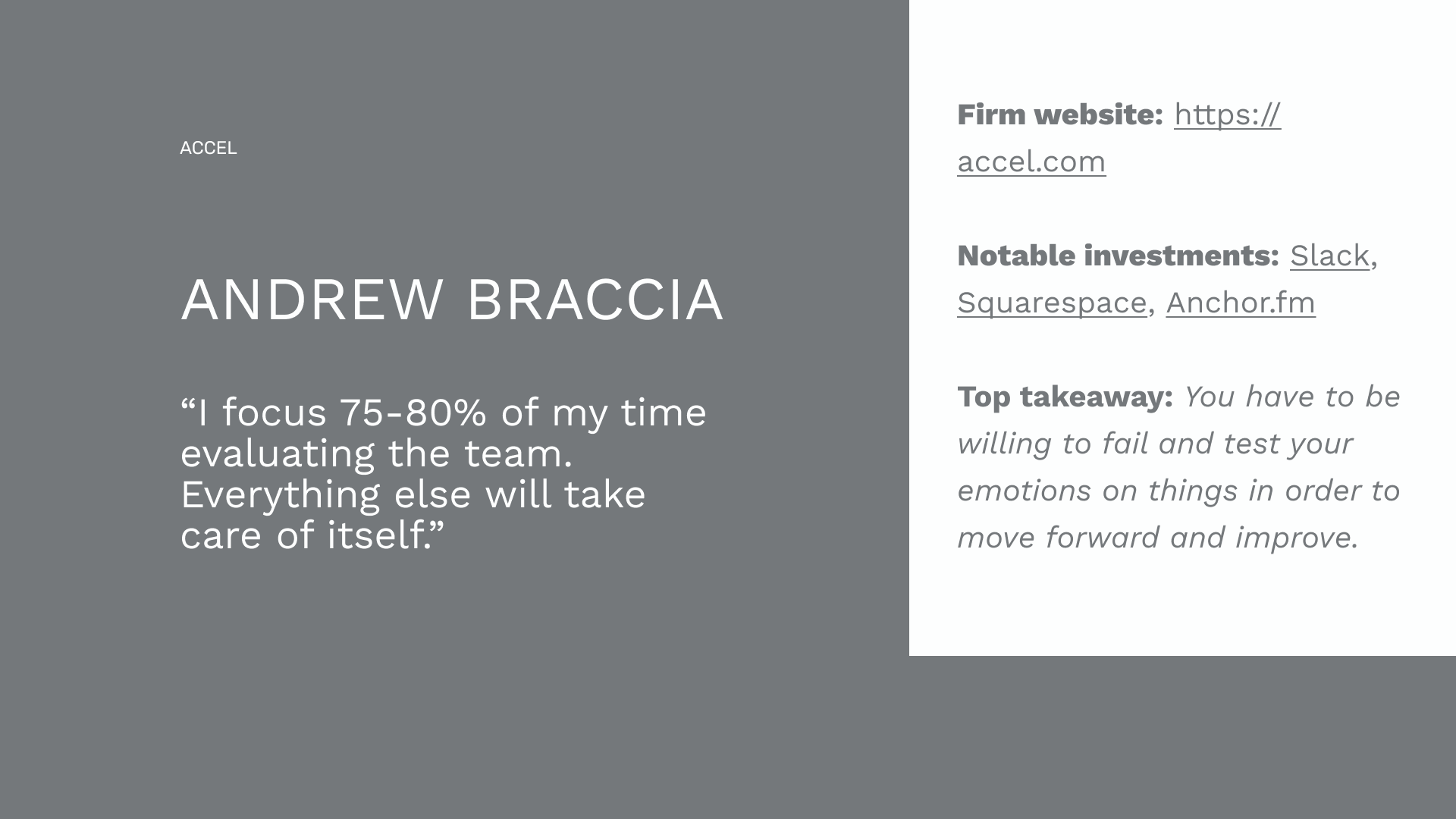

Andrew Braccia is a partner at Accel.

Similar to last week’s featured investor, Andrew lives under the radar. He has little-to-no online presence, and he rarely does speaking events. Most of the what you can find written about him is from several years ago.

Despite being hard to find, his track record speaks for itself.

He’s led investments into companies like Slack, Squarespace, and Anchor among others.

Here are some of our favorite lessons, quotes, and additional reading from studying Andrew.

"You should never run away from something. You should run towards something in your career."

Andrew Braccia

"There is no more competitive business than the venture capital business."

Andrew Braccia

"Chance favors the prepared mind."

Andrew Braccia

"The best entrepreneurs have bespoke stories around the problem they are solving."

Andrew Braccia

"I focus 75-80% of my time evaluating the team. Everything else will take care of itself."

Andrew Braccia

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t along.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.