Amish Jani is the founder at FirstMark.

He is based in New York, and FirstMark has become one of the elite funds based in the Big Apple.

Amish is relatively reserved, and he doesn’t do as many media appearances as some of the other investors we have profiled. When he does talk, people listen.

Here are some of our favorite lessons, quotes, and additional reading from studying Amish.

"Whatever your strategy is, be clear about it because it prevents you from wasting time on the noise."

Amish Jani

"Before you get to ownership, you have to get to access."

Amish Jani

“Venture investments are about evidencing enough ROI to overcome inertia.”

Amish Jani

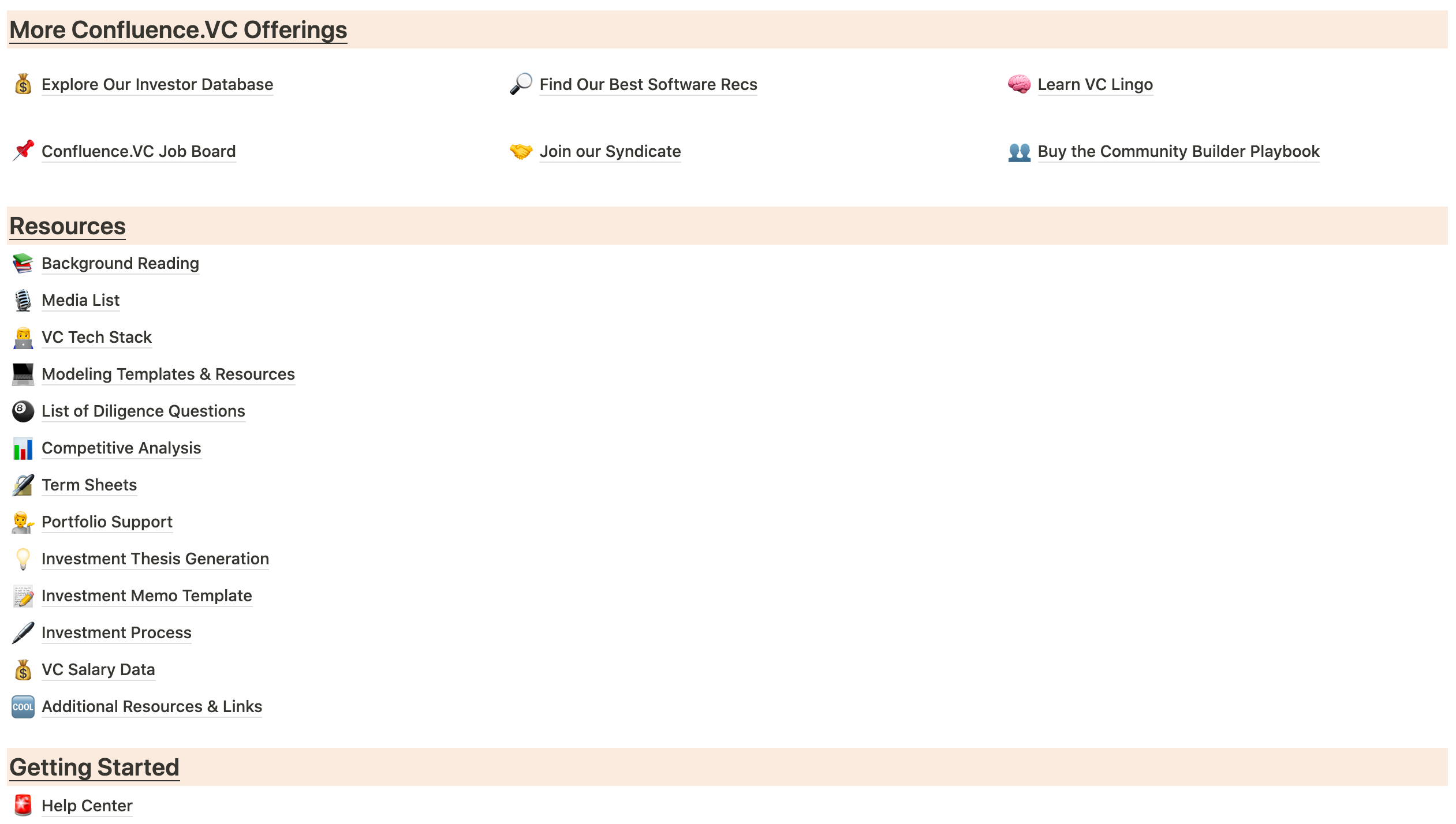

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t along.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.