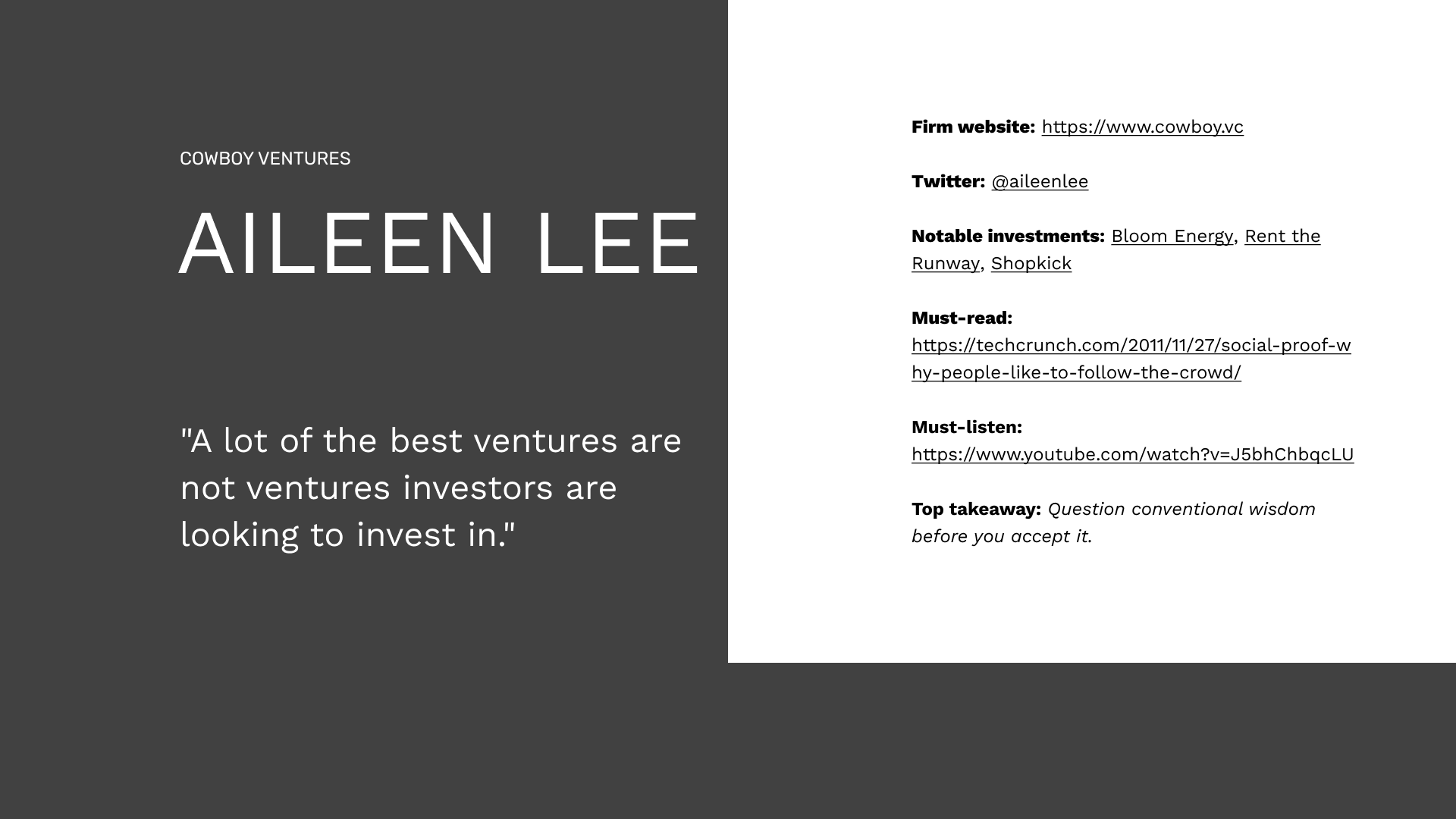

Aileen Lee is the founder and managing partner at Cowboy Ventures.

She’s also the co-founder of All Raise, she coined the term “unicorn”, and she spent over a decade at Kleiner Perkins before starting Cowboy. She’s already made a huge impact on the startup ecosystem, she seems to be universally respected, and we think her work is just getting started.

Here are some of our favorite lessons, quotes, and additional reading from studying Aileen.

Storytelling is a founders‘ biggest superpower. Those that can master the narrative have an upper hand in fundraising and recruiting.

In the fight for user attention, engineering social proof is the most important thing that marketing teams can do. Study the startups that build a cult-like following without spending a fortune on marketing (beehiiv is one example that comes to mind).

Look for and build relationships with advisors early. These people will help you see around corners. They will also keep you grounded before you get ahead of yourself. We built Confluence using this principle, and we think every founder and investor should take a similar approach.

Collaboration between investors is encouraged at pre-seed & seed. Competition is encouraged at Series A and beyond.

Introverts and extroverts pitch very differently. Before the pitch, ask the person pitching how they would classify themself, and it will allow you to steer the conversation in a way that benefits both of you. If you hate pitching in person and want to pitch VCs at scale, check out Commonapp.VC.

Venture is an access game. We’ve written about this at length here and here. Figure out early how you will see quality deals. Keep experimenting with different angles until you find your edge.

Investors think in the short-term and long-term when they meet with founders. If you cannot meet short-term goals, how will you reach the long-term ones? “Short-term impatience; long-term patience”.

Being thoughtful and empathetic as a VC is a trait that pays dividends. VC is one big game of telephone. If you suck as a person, word travels quick.

Get good at saying and supporting why you have to say “no” to companies. You say no >95% of the time. Learn how to deliver bad news in a thoughtful way.

Everybody has to suffer through “no’s”. Use these “no’s” to make them regret passing on you.

Question conventional wisdom before you accept it. The source is often more important than the message.

You can’t pay your way to product-market fit. You’re burning money on fire if you try to scale before deeply understanding the pain points of your customer.

“A lot of the best ventures are not ventures that investors are looking to invest in.”

“It’s more about slugging percentage than batting average.”

“The most important thing as an investor is venture judgement. This is a combination of people judgement, tech trend judgement, financial analysis, competitive analysis, product sense, and insights into markets.”

“You can win as a mercenary or missionary company.”

Social Proof is the New Marketing

VC Corner: Aileen Lee of Cowboy Ventures | Startup Grind

“You can’t get into the trap of paying for customer acquisition.” – Aileen Lee

I co-founded Cowboy Ventures and All Raise – Aileen Lee

‘Don’t wait to be perfect:’ 4 top startup tips from a unicorn’s founder and investor

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t along.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.