The best venture capitalists are always on the lookout for good deals.

A venture capital firm only makes money when one of their companies is bought or sold, so investors are always on the hunt for their next company success story.

So, where do they find potential deals?

In this article, we’ll dive deep on what deal sourcing is, why it’s important, how VCs find deals, and where to improve your sourcing skills.

We’ll focus primarily on how these tactics can be used by venture capital firms, but the same strategies can be used by growth equity, hedge funds, and private equity firms as well.

Sourcing (sometimes called deal origination) is the process of finding and evaluating potential investment opportunities. For VC firms, sourcing is all about identifying companies with high growth potential and then pitching them to the other investors in the fund.

There are a number of ways to source deals, but the most common method is through networking. VCs will typically network with entrepreneurs, business accelerators, and other VC firms to find companies that are looking for funding. The old adage the VCs should always be sourcing holds true.

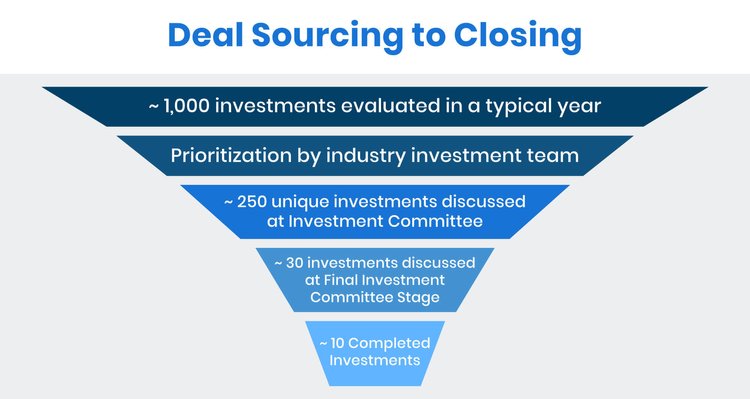

Before a company gets funded by VCs, they first stage they have to go through the deal flow process for a given fund. Sourcing is the first part of that process, and filling a pipeline is arguably the most important job of a venture capitalist.

All potential investments must go through screening before moving to the next stage. This step usually requires due diligence, company data requests, competitive analysis, reference calls, partner review, and investment committee briefs. If the company passes all checks at this step, they’ll move to the next.

This usually requires in-person meetings to pitch the company and ask any questions that came up during the last step that the team was unable to answer in their due diligence process.

From here, the opportunity will go to a vote from the investment committee, and they will decide whether or not to move forward with an investment.

Sourcing is the most important aspect of a VC’s job.

Funds only make money when the companies they invest in do well and exit through an IPO or M&A. Therefore, it’s impossible for VCs to make money if they aren’t investing in great companies with serious potential to exit one day.

Since it’s impossible to invest in great companies if you don’t have access to them first, you can start to understand why there is so much of an emphasis on finding new investment opportunities.

The best VC funds are constantly on the lookout for new chances to invest in early-stage companies.

They will hire based on a person’s network, and that person’s network will make it easier for them to get in the door to great opportunities.

Venture capital deal sourcing is an art, not a science. To get into good deals, you have to have good positioning.

If you take anything from this article, it should be this: sourcing is the lifeblood of funds, and funds will do anything they can to improve their access to better deal flow.

As a VC, your ability to get into good deals should compound the longer you’re in the game. If it’s not, you’re doing something wrong.

Deal sourcing comes down to one thing, and that’s having access. Access comes in many forms.

It could be from your college alumni network.

It could be from other founders you’ve helped in the past.

It could be from other co-investors you’ve worked with in the past and are interested in trading deal flow.

It could be from online communities you are a part of.

It could be from an audience you’ve built up online from sharing information.

It could be from deal sourcing platforms you pay for.

It doesn’t matter. More deal flow sources are a good thing, and it allows you to filter more investment opportunities to find winners.

If you’re getting started in venture today, one of the highest ROI activities you can do is expand your network.

You should make it a goal to meet somebody new every day whether that is in person or IRL. It might feel uncomfortable doing this at first, but it will pay dividends over time.

Again, venture capital deal sourcing is an art, not a science. Everybody has a different deal flow, and you will need to create your own unique sources.

For this section, we’ll focus on three main buckets: in-person networks, online networks, and your personal audience.

In-person networks are the strongest type of network.

These types of networks are a way for like-minded people to gather, share their thoughts, and meet other people they share something in common with.

If you’re looking to grow your network, the best place to get started is to join more in-person networking events around your area.

Here are a few examples of how investors at VC firms leverage these types of places for better potential deals in the future.

SaaStr is one of the top tech events hosted every year.

These are events that everybody goes to.

It’s hard to meet relevant folks at some events, but not these types of events.

These usually happen only a few times a year, and they are great places to build relationships and grow your collective network.

It’s 2022, and where you went to school still matters despite people telling you otherwise.

Alumni networks look out for each other. They’re able to instantly connect on something, and it gives the people an easy filter to apply before the meeting.

There’s a reason that people will still pay hundreds of thousands of dollars for a diploma, and it’s because of the doors it opens later in your career.

Founders are some of the best introduction sources to other founders.

These types of people like to hang around each other, and many of them bounce around ideas and work through problems together.

Founders are constantly dealing with problems, and they could always use an extra hand.

If you’re currently working in venture capital, do everything you can to be a resource for your portfolio companies. They will remember it, and they’ll reward you by introducing you to other quality founders they’re friends with.

If you aren’t working in VC yet but want to, make friends with founders in your area. Learn more about what they’re working on, see where you can help, offer pro-bono consulting. You’ll learn a ton in this process, and you’ll also open up access to different parts of the founder community.

Meetup and Eventbrite share in-person meetups happening in your city every week

Depending on where you live, chances are there are dozens of meetups you should attend every month. This is an easy way to build up personal networks, and those can translate into opportunities later.

Places like Meetup and Eventbrite will even help you find these types of events, so you should have no excuse.

Local organizations will also have chapters for different backgrounds. Universities will also set up alumni groups in different cities.

Obviously, the quality and amount of these types of networks will differ by geography. There is a reason that before startup geographies became decentralized, traditional deal sourcing required you to be near San Francisco (luckily that has changed.)

Regardless, the same principles still apply. Every market has interesting people to meet, it’s just up to you to find them.

The shift to online has already happened, and if you aren’t paying attention the right online platforms, it will be hard for you to get access to the best information. Online deal sourcing is a cheat code if you’re able to do it well.

Especially as a VC, your job is to be getting in front of people that are building businesses online.

If you can find where these types of people are already congregating, you have an advantage when it comes time to source.

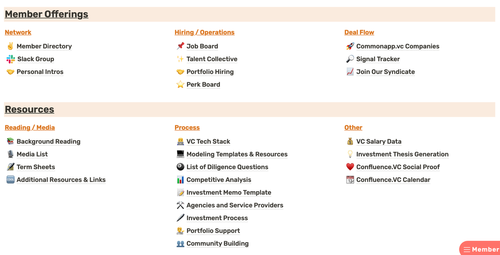

Slack groups are a great way to meet people and also get your hard-to-find questions answered.

Most Slack groups are segmented and include a highly-targeted group of people that you can meet with.

We’ll warn you though: if you have a transactional mindset about joining an online community, you won’t last long, and moderators will kick you out. When you get set up, introduce yourself to the group, ask and answer questions, and do not promote yourself. Use your membership as a chance to add value to somebody else, and you’ll be rewarded.

Private online communities are great because they usually have sort of barrier to entry. Getting tapped into these types of communities skips a step in the diligence process by letting somebody else (in this case the community organizer) do the first step of the deal screening for you.

Here are a few of our favorite online communities grouped by their types of members:

Microstartups

No-Code Founders

SaaS Founders

Remote Work

Venture Capital

Knowledge workers are only as good as the information they consume, and newsletters are a great way for VCs to get aggregated bits of information delivered straight to their inbox.

A lot of newsletters today even focus on highlighting companies that have either just raised venture capital or are in the process of fundraising.

Term Sheet and Pro Rata are some of the best newsletters to get daily recaps on what financings happened yesterday.

If you’re looking to get early-stage venture capital deal flow delivered straight to your inbox, check out this free newsletter.

Reddit can be a gold mine of information, but you’ll definitely have to do more digging to find what you’re looking for.

People on Reddit typically are using it just for information, but there is still some value in using it for your business.

Here are 30 subreddits worth checking out to meet people, grow your network, and expand your deal funnel.

Marketing / Sales

Growth

SMBs

VC + Crowdfunding

LinkedIn groups can also be a good place to expand your network, but they’re probably the weakest type of online network compared to the options listed above.

Getting plugged into LinkedIn groups works best if you are more established and looking to network with those that are in the middle of their careers.

The younger generation is not as active on LinkedIn, and we think you’re better off spending your online deal sourcing efforts in other pockets of the internet.

In the attention economy, having an audience is the ultimate asset. In venture capital, an audience makes you indispensable to your fund.

It’s a form of leverage that gives you superpowers. You’re able to connect with more people, spread your ideas, and generate more luck out of thin air compared to somebody with no following. All of these forms of leverage allow investors to attract deals to them instead of them having to do direct sourcing all day long. As long as you continue to deliver value to your audience and you maintain a good reputation, an audience can be the key to your personal deal sourcing strategy.

The way we see it, there are basically three ways to build up an audience that can generate more deal flow: a personal newsletter, Twitter following, or personal blog / YouTube channel.

We’ll break down below why each of these are the most defensible ways to source deals consistently.

Newsletters are a great way to share ideas and provide some sort of value to the reader. You can write about whatever you want as long as there is an audience for it.

Some people condense the news into bite-sized bits that make sense.

Some share jobs in a niche field.

Others write deeper articles explaining their views on the world.

As long as you consistently show up, stick to a content schedule, and provide enough value for your audience to open and click through what you’re writing about, you’re creating a form of leverage through an audience.

Newsletter writers have no leverage when they first start (long hours writing to few people), but their leverage scales exponentially as their audience grows (less hours writing for more people).

A newsletter is an owned audience which means that you control when your audience sees your message. Compare that to a social media audience where you are at the mercy of the algorithm, and you can see why having an email list is so important.

Consistently posting with your list will also earn you mindshare with your readers, and you can decide what you do with that mindshare.

I’ve seen many VCs use their personal newsletter to remind their audience where they work and the types of deals they are looking at. This is a great way to position yourself if you want more inbound deal flow instead of having to play the outbound game all of the time.

Building a Twitter following has been the most popular form of audience building for VCs over the past few years, and it makes sense as to why.

People in tech generally spend a lot of their free time on Twitter. They use it for information, and there’s been a huge opportunity to create and capture the attention of these people with in-depth threads, insights, or wit.

Compared to a newsletter, I’d argue that any form of social media following is not as valuable for the reasons mentioned above, but any audience is valuable nonetheless.

The more you share, the more is shared with you, and sharing your findings on Twitter is still a great way for VCs to land more inbound deal flow.

A personal website, blog, or YouTube channel is still a great way to build an audience, and those that have done this well have countless doors opened for them.

The benefit that all of these channels have over Twitter and newsletters is that you are able to easily tap into search volume that is already happening all over the internet.

We won’t get into too much detail on the 101 of SEO and how search affects traffic numbers, but the TL;DR is that search is a MASSIVE opportunity, and you are leaving money on the table if you are not building content around existing search demand. Blogs, personal websites, and YouTube videos allow creators to do that, and that is why we think they’re great tools for VCs to use to get more inbound deal flow.

We said it before, and we’ll say it again. Sourcing is an art, not a science.

Winning allocations into the best deals is the only thing that really matters in venture capital. If you aren’t able to find the best companies, you won’t generate the best returns.

It’s really that simple.

It’s why funds largest operating expense is usually to hire junior talent to source and evaluate as many companies as possible.

It’s why more and more resources are going into creating content and winning over attention.

It’s why the power of an audience is only going up in value.

Sourcing is the lifeblood of any fund, and funds are being forced to spend more resources in order to find great companies.

If I was starting my career in venture today, I would do everything in my power to get tapped into as many networks as possible.

We live in a world where it’s never been easier to meet people in person or in real life. If you’re serious about expanding your network, you should be doing something to meet new people every day.

You can also increase your sources of information, get plugged into the right online communities, and start building out an online presence. None of these things are necessary, but all of them will help you out in the long run.

The last thing to mention is a quick reminder that sourcing comes down to building quality relationships, and maintaining relationships takes time. You can’t expect people to fully trust you within a few interactions. You have to keep showing up and offering value.

Venture is a long game, and you want to find people to play that game with. The sooner you start, the better.