Explore all of our investor deep dives here.

"What you're looking, for as an investor is high utilitarian outcome, and the ability to capture it.”

"People get a dopamine from things they have made money in before." This allows for marketing ploys that are meant to cloud judgement.

"Where are the incredibly qualified people in the weakly competitive labor markets?"

"Someone interested in power tends to be better at execution; someone interested in money tends to think more about capital efficiency. Avoid people interested in fame."

“In boring and complex businesses, the spiritual reward of the industry are lower, and so you get fewer entrepreneurs. Therefore, the chances of succeeding in boring and complex businesses is significantly higher.”

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t alone.

Junior VCs don’t get training. You’re forced to figure it out on your own.

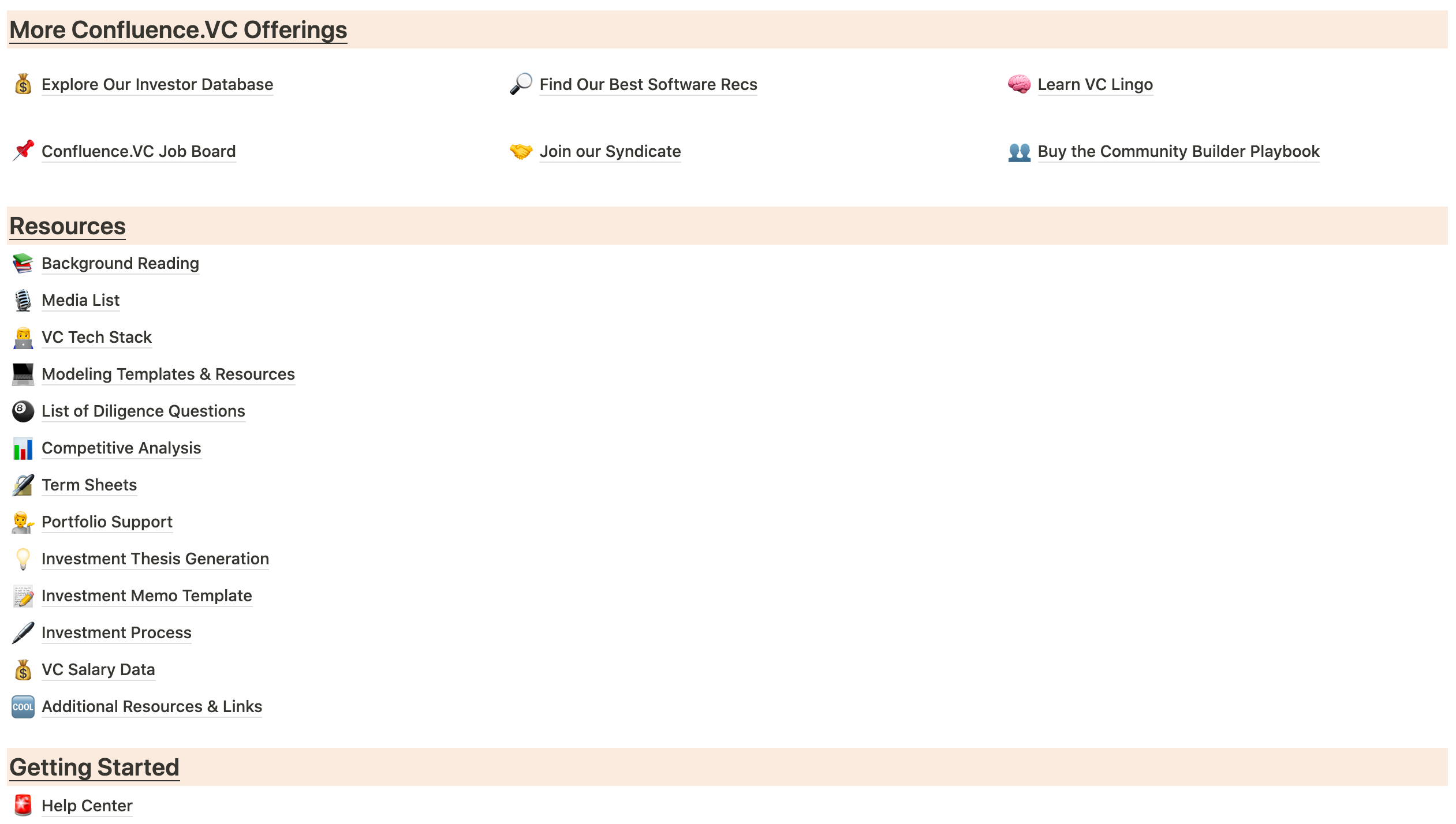

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.