Brian Singerman (@briansin) is a partner at Founders Fund.

Founders Fund is widely known as one of the best funds in the world, and Brian focuses primarily on backing the best founders regardless of industry.

Here are 15 lessons we learned after studying Brian and his career.

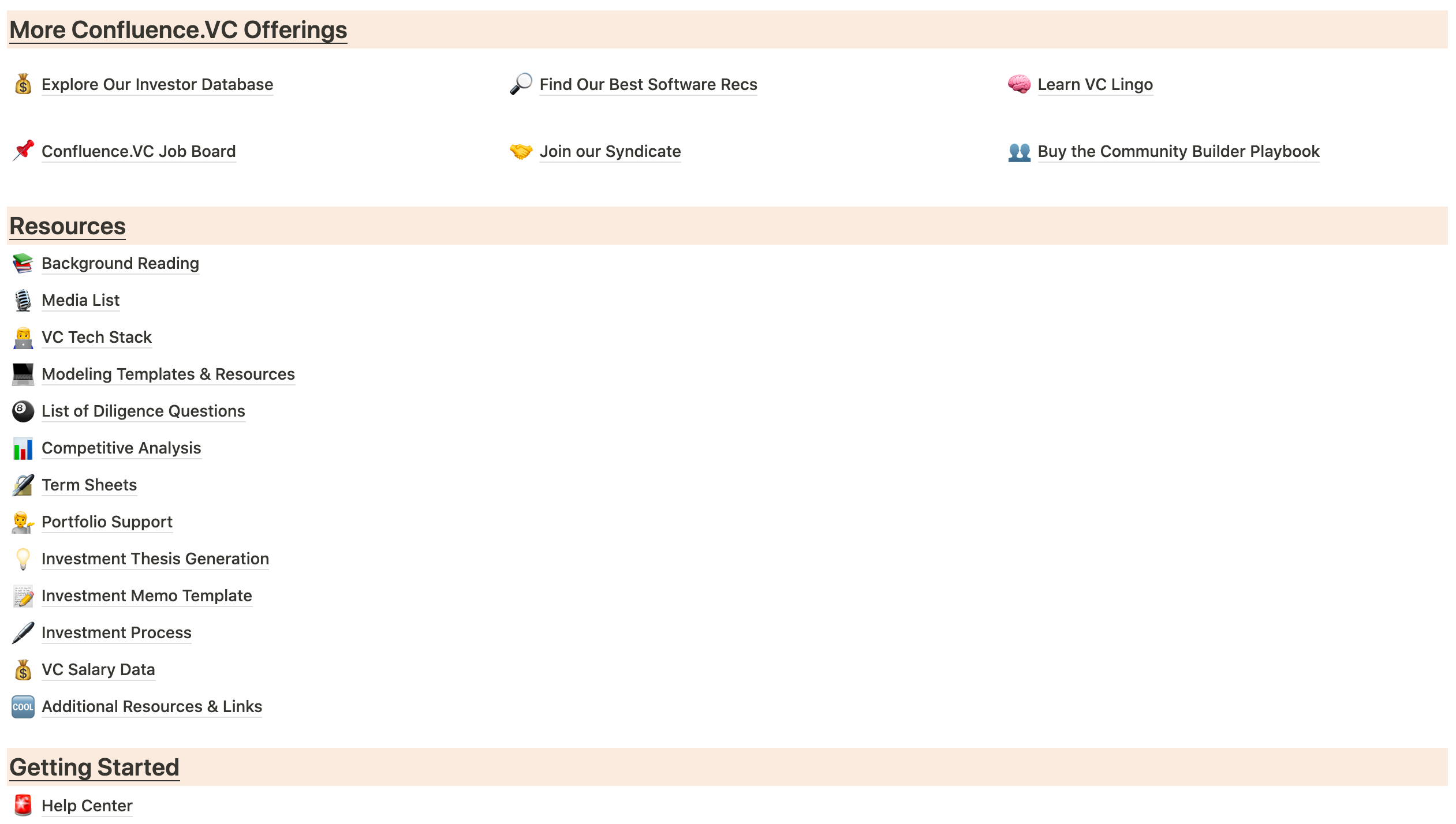

VC Tech Stack: 88 tools used by tier one VCs

Investment Memo Template: our boilerplate template for memos

Venture Media List: 132 people and places to learn the game

ChatGPT Prompts: prompts to give VCs more leverage

Diligence Question Bank: 84 questions to ask founders

"The way you make money in venture capital is by backing the truck in and being correct. I'm not looking for validation from other VC firms at all. I’m not interested in marking up a portfolio of companies. I'm interested in these companies being very large and having impact."

"Going public is a singular event, but it is not the final event for a company."

"Venture capital is a game of purely upside maximization."

"The only way to learn about investing is by investing."

"I'm not saying there's anything wrong with the having a thesis and being proactive and knowing the space better than anybody else. I just don't know what you do when there's not a great company in that space. I am just very very very dogma free and open to anything that walks in the door."

"Jobs that deal with human caring will accelerate rapidly as automation becomes more embedded into society.”

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t alone.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.