Want to cut to the chase? Brex is the best financial forecasting software.

Between its drag-and-drop customization, powerful automation, analytics-driven reporting, and additional financial capabilities, you’ll be hard-pressed to find a better budgeting and forecasting software anywhere else.

Finance, accounting, RevOps, and the C-suite all live on financial data. But they all use it differently and need it to tell them different things.

Excel spreadsheets and manual tracking aren’t scalable, especially once a business raises capital, expands its market share, and grows internally.

Financial and operational planning used to be one of the most challenging, time-consuming, and inexact functions.

Now, companies use financial forecast software to remove the guesswork and automate the process.

We’ve invested in dozens of companies, witnessing firsthand how different tools can make or break a company’s financial operations. This list highlights the 11 best budgeting and forecasting software available today.

In its simplest terms, financial forecasting describes the process of predicting future financial performance based on historical data. It helps businesses plan and allocate resources strategically for maximum efficiency and growth.

Different functions use financial reporting data differently.

A company’s financial metrics guide decision-making for the entire organization. Everything from resource management and workforce optimization to supply chain planning and marketing activities requires data-backed financial forecasts.

IBM data shows us more than half (58%) of mid-size to enterprise companies still use spreadsheets to manage their budgeting and forecasting processes.

That’s a lot of manual effort, and it usually leads to inaccurate data.

If you want to remain competitive and keep your company running smoothly, Excel isn’t the way to go.

Forbes Finance Council member and FinTech CFO, Omar Choucair, outlines the best way to plan budgeting and forecasting in a late-2022 Forbes article.

“Implement improved forecasting models and set achievable growth targets,” he explains. “Invest in digital transformation to optimize your team and processes.”

He’s right — using digital tools (like budgeting and forecasting software) to streamline financial reporting processes improves efficiency and accuracy, helps smaller teams manage their mountainous data, and gives finance teams more time to focus on strategic, value-added tasks.

It can also maximize employee engagement and support business growth initiatives.

In the face of ongoing volatility, you need to optimize your operational processes with the right digital tools. In a financial context, that means implementing budgeting and forecasting software.

These 11 tools are the best ones for the job.

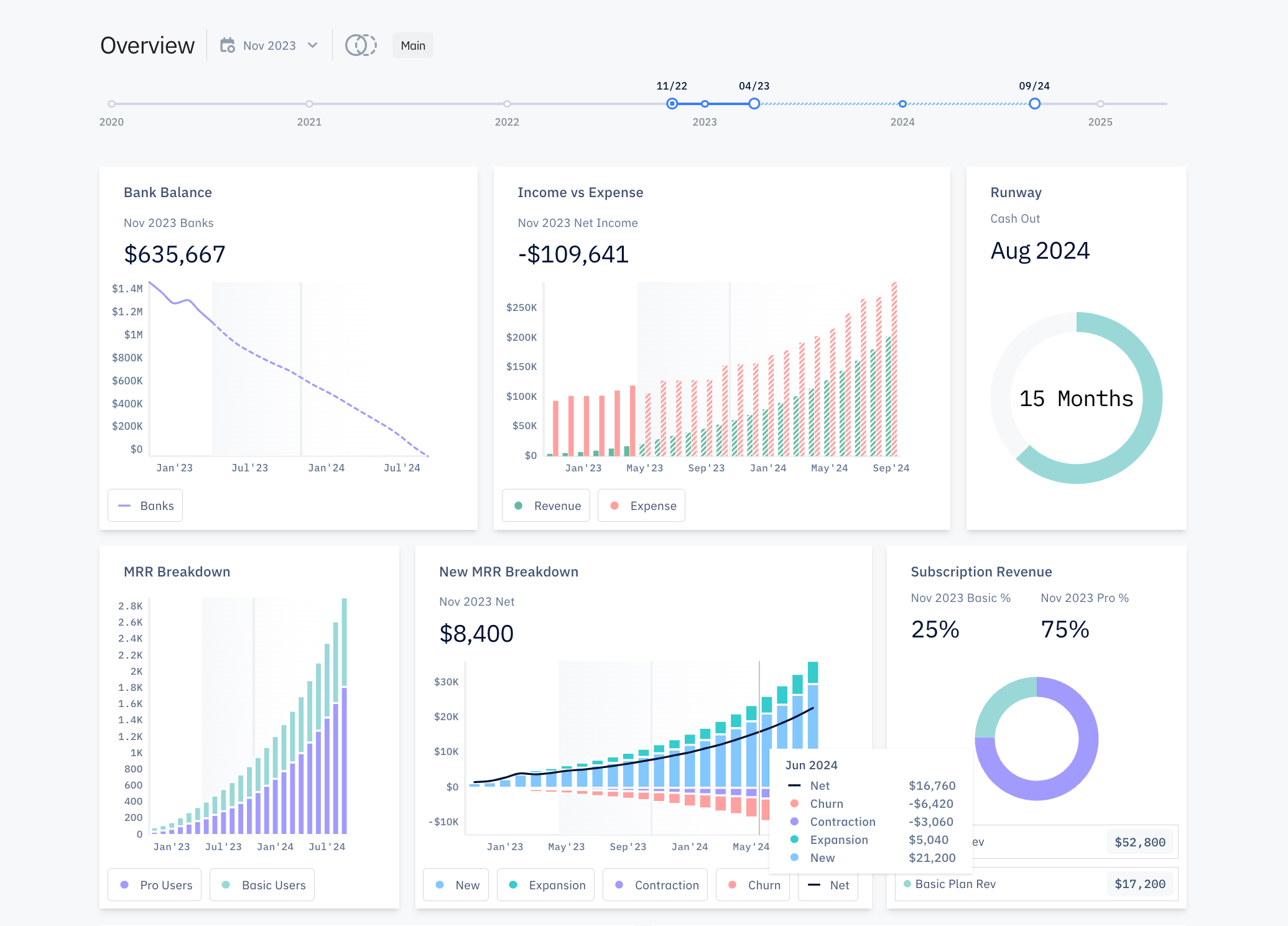

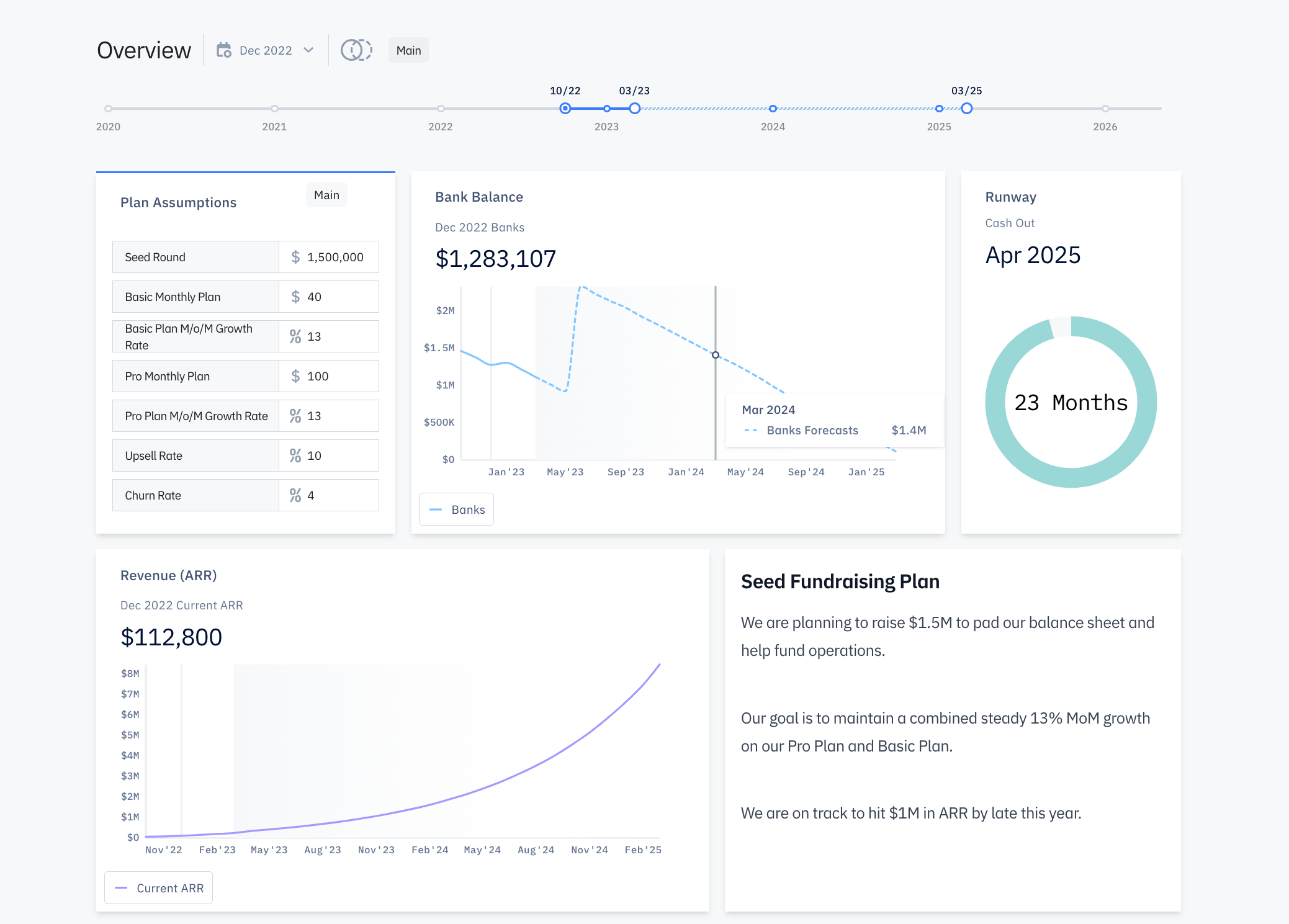

In 2022, Brex acquired Pry, the new financial modeling backbone of the Brex Empower platform. It’s the complete package for companies that need autonomy, accuracy, and speed in their financial planning.

Thanks to its ease of use, complete feature set, fast deployment, and low cost, Brex is by far the best tool for CFOs and finance teams that want comprehensive visibility of their finances.

Brex is a platform with no setup or ongoing fees.

Brex Premium (the software layer required to access its forecasting features) is available for $49/month.

Brex is unique in that its features and benefits (e.g., fast implementation process, excellent corporate card program) are geared specifically toward scaling SaaS businesses and modern enterprises.

Its corporate performance management functions make it the ideal solution for enterprises and scaling companies that need fully integrated finance and budgeting software.

Read more: Brex Review: Requirements, Features, Pros and Cons, Plus 50k Free Signups Points

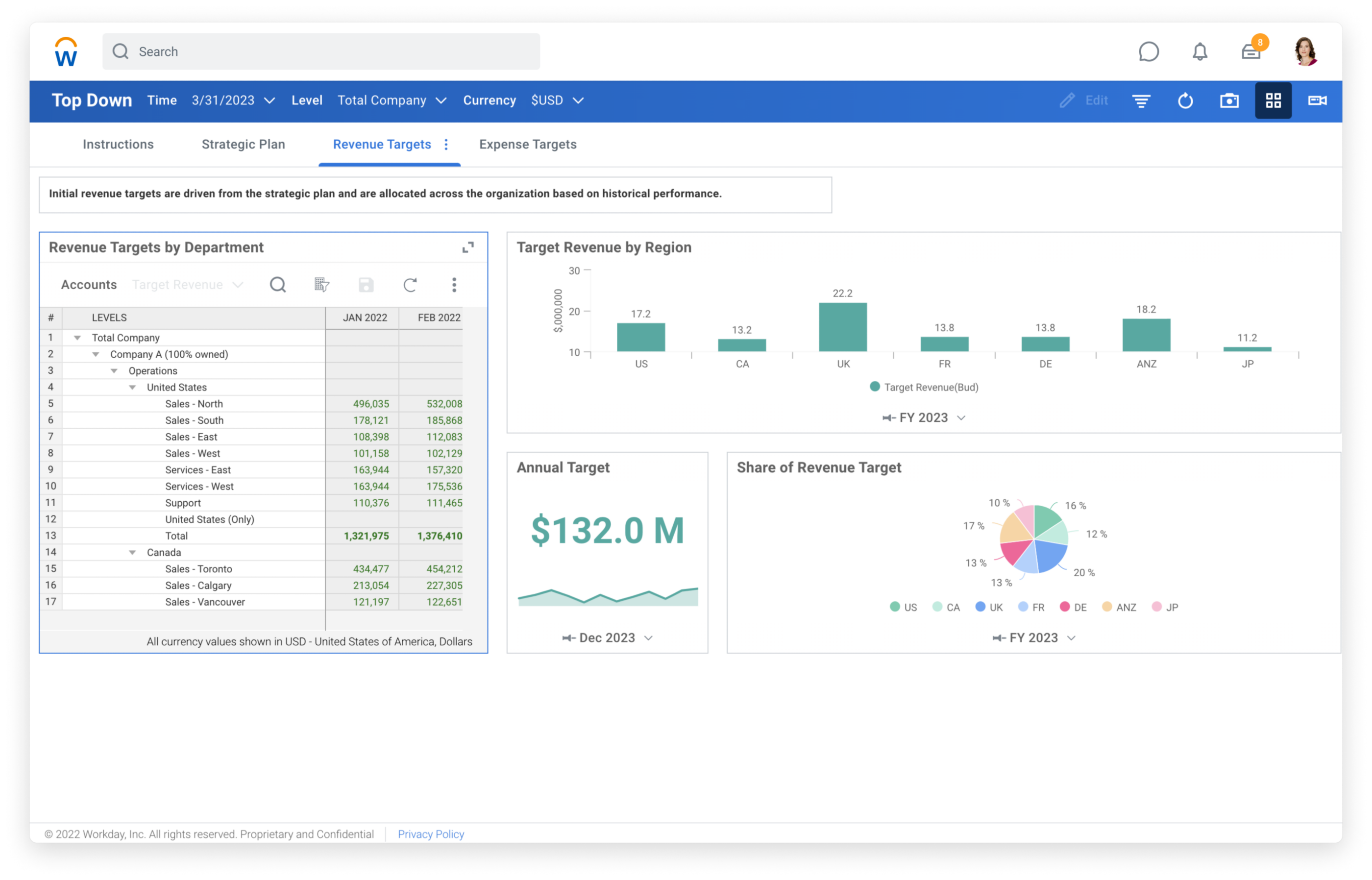

Workday Adaptive Planning (previously Adaptive Insights) is a holistic corporate performance management (CPM) solution. It’s a robust tool that seamlessly combines planning, modeling, budgeting, and forecasting to foster collaboration across the enterprise.

Adaptive Planning uses a two-tier per-seat pricing model with pricing depending on features, solutions, company size, and types of users using the budgeting and forecasting software. Some sources say pricing starts at $15,000 per license.

Workday Adaptive Planning serves customers in every sector, from retail to nonprofit to healthcare. Its price and features, however, make it better suited for larger or more complex organizations. Companies generating $10M-50M in revenue with 1000-5000 employees are Adaptive Insights’ main customers.

If you’re a die-hard spreadsheet fan but long for the powerful features of a dedicated FP&A tool, Cube is here to bridge the gap.

It’s the first spreadsheet-native budgeting and forecasting software, offering you the best of both worlds: the familiarity of spreadsheets and the power of enterprise-grade software.

Cube’s selling point is its simplicity and flexibility. It eliminates manual work, delivers real-time insights, and lets finance teams strategize with speed and agility.

Cube offers three pricing tiers:

Additional charges apply for custom integrations, additional systems, and multiple users.

“Spreadsheet-native” is either a selling point or a huge drawback for prospective buyers. Cube is ideal for organizations that don’t want to part ways with their established work style but still crave the power of a full-fledged financial planning solution.

Anaplan is a versatile forecasting tool that connects every aspect of your business, from sales and finance to supply chain, IT, marketing, and HR. Anaplan’s commitment to the cloud, data science, and AI guarantees efficient, accurate forecasting and continuous planning.

Anaplan’s pricing is quote-based, meaning prospective customers need to book a sales call before moving forward.

Anaplan’s powerful AL/ML components make it reliable for large companies with extensive data science and IT infrastructure. Alphabet and Tableau are two examples of current Anaplan customers.

Originally called Host Analytics, Planful rebranded in early 2020, pivoting its focus toward mid-market customers. Its claim to fame is its financial analysis tools, which help tremendously with budget planning and financial project management.

Planful uses quote-based pricing and does not publicly disclose any information. However, many of its online reviews indicate its relative affordability.

Planful is a go-to for mid-market companies in search of a solid budgeting and forecasting software solution. Smaller organizations find the system has more features than they need, while larger companies quickly learn that its affordable pricing has a tradeoff.

Prophix is a corporate performance management software designed for accounting and finance automation. Offering both cloud-based and on-premise options, Prophix assists finance teams by streamlining budgeting, planning, consolidation, and reporting, even those with sensitive data.

The cost of Prophix is based on your organization’s specific needs. For a personalized quote, it’s best to reach out to them directly.

Prophix’s multi-ERP integration, collaborative features, and profit and revenue forecasting abilities make it ideal for construction, real estate, manufacturing, and other project-based businesses.

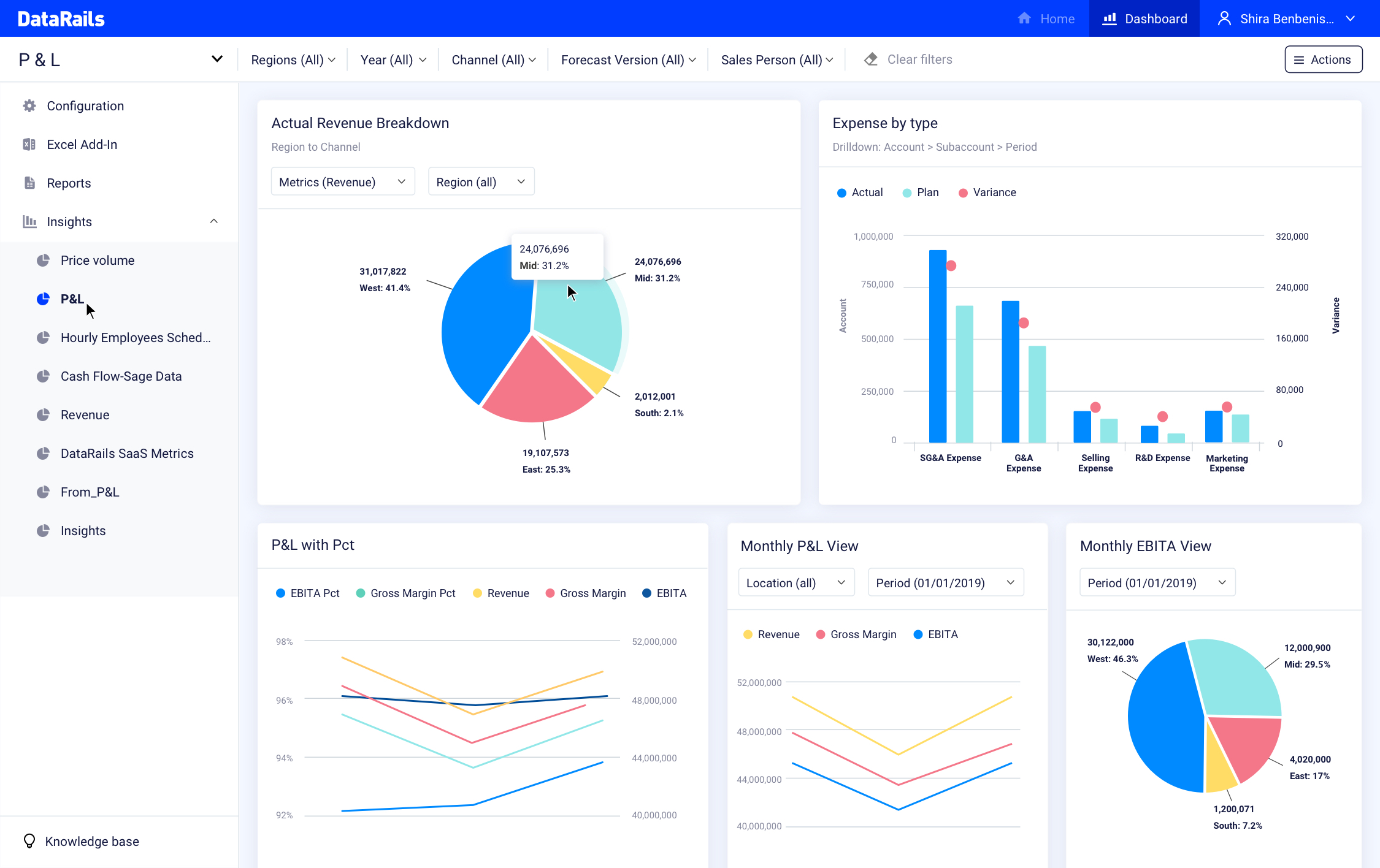

If you’re a fan of Excel, you’ll love DataRails. It’s a budgeting and forecasting software that allows finance teams to continue working in the Excel environment—with enhanced financial data and visibility, of course.

DataRails automates data collection from your organizational systems and spreadsheets to create a unified database of all your numbers.

Each package is tailored to the individual company’s needs. Factors like business goals, use cases, number of users, and integrations all come into play when determining pricing.

DataRails works well for smaller businesses that heavily rely on Excel for financial forecasting and other financial processes but face challenges when locating and organizing data across numerous spreadsheets.

Jirav is a complete planning platform for organizations where spreadsheets just won’t cut it anymore. Based on historical data, Jirav forecasts future financial performance on your P&L, balance sheet, and cash flow statements.

Its unique integration with financial statements makes it easy to communicate revenue projections to investors and create future budgets.

Jirav offers three pricing tiers:

Jirav is primarily designed for small businesses, particularly those keen on migrating their financial budgeting from spreadsheets to a modern interface. For small companies seeking funding, Jirav also assists in preparing investor packages, making it a valuable tool for financial growth and sustainability.

OnPlan is built on Google Sheets and BigQuery—two of the world’s most secure cloud-based platforms. This budgeting and forecasting software blends the flexibility and familiarity of spreadsheets with modern visualizations, integrations, and collaboration to arm you with superior financial modeling capabilities.

OnPlan uses a three-tiered pricing structure featuring Growth, Growth+, and Enterprise tiers. They include various levels of features, but each is customized to the individual customer.

OnPlan is an excellent choice for small to mid-market organizations aiming to minimize financial modeling errors typically associated with spreadsheets. The financial forecasting software helps businesses across numerous verticals take a customized approach to budgeting and forecasting, with critical data points more identifiable than those in spreadsheets.

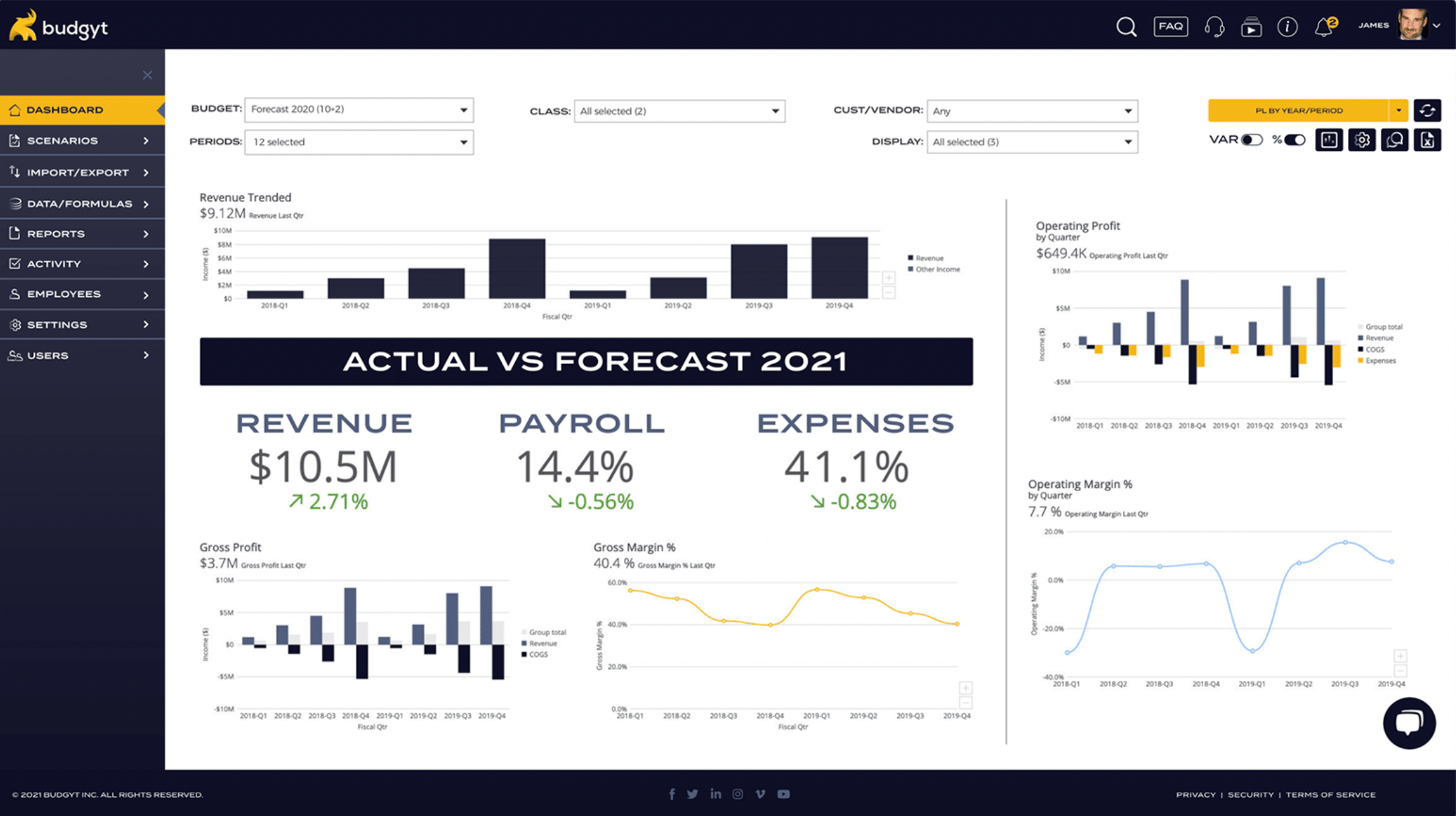

Budgyt is a financial budgeting and planning software for companies that have multiple P&Ls, which include multiple entities, departments, and divisions. Built for businesses of all sizes and secured on the AWS cloud, Budgyt is equipped to make budget planning easier and safer.

Budgyt offers three tiers: Easy, Plus, Pro, and Enterprise. The total price of using Budgyt varies from customer to customer, but the basics are as follows:

Budgyt is ideal for any business with multiple P&Ls, including franchises, nonprofits, and companies with revenue streams from multiple sources (e.g., retail, healthcare, manufacturing, and hospitality). Budgyt’s version control system makes it particularly suitable for businesses with project-based accounting.

Casual is a solid upgrade from spreadsheet-based financial management reporting. Less reliance on complex formulas and more emphasis on user-friendly, interactive features helps users focus less on the forecasting and budgeting process and more on outcomes.

Casual offers three main pricing tiers:

Website and Notion board integration make Casual an attractive option for solopreneurs, online business owners, and tech startups building a lean, integrated tech stack. Still, it caters to companies with up to 1,000 employees, thanks to its data warehouse integration and sophisticated revenue forecasting algorithms.

Although the best budgeting and forecasting software varies by industry, company size, and organizational structure, Brex is the clear winner.

Unlike all other products on our list, Brex is more than a forecasting or budgeting software. It’s a complete financial management platform.

Since Brex also offers business banking, corporate cards, and expense management tools (among many other great features), you can manage every element of your financial infrastructure in one place.

With its recent acquisition of Pry, Brex is the only company uniquely positioned to offer all of these features while offering one of the world’s most robust financial modeling tools.

We’ve watched startups scale from seed funding to $10M ARR while Brex handles everything from forecasting and budgeting to cash flow, banking, and investor relations.