Confluence.VC 2021 Recap

2021 was crazy. We were able to turn this community into a business, and we were only able to do that because of the support

VC hiring is never as easy as it seems, and this bad hiring process results in bad investment teams.

Venture funds operate on a fee structure, and this structure impacts their hiring decisions. Firms need investors with unique skill sets and networks, and they typically need to convince them to work at a discount to their market rate due to their limited budget (this is more of a problem at smaller funds with lower assets under management). If you’re looking for more venture salary data check out our VC salary survey with a full breakdown of salary, bonus, and carry for different roles.

There is no standard hiring process within venture, and if you interview at ten different funds, you will have ten very different types of interviews. Roles in VC are loosely-defined, and this lack of structure results in a lot of subjectivity when choosing who to hire.

Good funds focus on hiring the best people; great funds focus on retaining them. This is meant to give some more context to why the VC hiring process is difficult for both sides of the table.

There are many ways to get involved with venture capital, but no single route leads directly from college to starting at a fund. 40 percent of junior analysts at top firms came from consulting or banking jobs, about 15 percent came from software companies, and only 4 percent had experience as founders or angels.

In other words, there is no standard path, and even if you have a startup background, it doesn’t necessarily mean that you can use it to your advantage when applying for jobs.

Most analyst and associate roles are portrayed as glamorous, but it’s actually much different on the inside. At most funds, these roles are essentially SDR roles except instead of selling a product, you’re selling capital. These people are on the phone all day long talking to companies, and they are evaluated on the deals that they bring in every quarter.

The promise to “work closely with founders” sounds cool until you realize that the typical extent of the analyst-to-founder relationship is the analyst requesting KPI data from the founder on a monthly or quarterly basis. Strategic help to founders is usually covered by the partners or deal lead, and junior investors don’t have much say or pull when it comes to helping portfolio companies operate.

Doing outreach and talking to companies will improve your EQ and soft skills, but analysts and associates typically struggle to build a tangible skill set beyond that. This, in theory, reduces their employment options post-venture, and a majority of junior investors will admit this is one of their biggest frustrations within the role. Many of these investors today are trying to compensate for their lack of skill building by being active on Twitter to build an audience and boost their luck when it comes time to move on.

Software investors are taught to evaluate businesses by revenue churn risk. Using that same logic, businesses should also be evaluated based on employee turnover.

VC is an apprenticeship business, and investors should have their network, deal flow sources, and judgment compound each year they work at a fund. Losing a good employee too early interrupts that compounding, and it can be an expensive mistake for any fund.

Most people do 2-3 years as an analyst / associate before making their next move. The typical path is to either be promoted to a principal, start your own business, go to business school, or join a portfolio company in an operating role (we weren’t able to find data on the dispersion of those outcomes, but anecdotally it seems like a pretty even split from what we’ve observed with our friends in the industry).

Junior VCs leave for a number of reasons, and it is up to the partners to address these issues. The common reasons we hear for turnover are a combination of lower salary, a lack of upside in their work (no carry), non-present partners with no mentorship opportunities, or the inability to build tangible skills.

The consensus among partners is that they would rather have someone stay for the long haul, but in order for that to happen, concessions need to be made, and that usually comes in the form of better compensation, better economics in the upside of the fund, or title promotions. Partners also hold a lot of the leverage in contract negotiations because of the supply and demand imbalance of venture roles; unless a junior person is truly a top performer, there will always be somebody else that wants to replace them in their role (usually at a discount).

The average time to exit for venture investments is seven years. This means that nobody actually knows how good (or bad) of a job junior investors are doing for half a decade.

This yields an unfavorable position when it comes time to negotiate salary because junior investors cannot rely on tangible evidence of the value of their work. Some firms will reward markups on deals sourced, but that isn’t always a great indicator (it only means that another investor was willing to bid up for a piece of that company at a higher valuation). Others reward loyalty through vesting periods on their carry – this entitles investors to larger percentages of the upside the longer they stick around, but less than 20% of junior VCs get any carry at all.

This plays into the larger issue around compensation, and it should give some more context to why fund managers have their hands tied. You want to reward good work, but if you don’t have a fair and effective way to do that (which most funds don’t), you can’t expect your top performers to stick around.

Nobody cares what you can do; everybody cares about what you can do for them.

VC is an access game, and the majority of a junior VCs’ time is spent improving levels of access.

The best companies are the hardest to get in front of. Funds want to hire people that boost their chances of getting in front of these types of companies.

In the past, alumni networks helped with this, but now more and more deals are being done on Twitter and other parts of the internet. This explains why the play over the past five years has been to grow an audience, use that audience for deal flow, and comb that deal flow to get equity in great businesses.

In short, network matters, and if you can’t prove that in or before an interview, you’re behind somebody else that can.

We’ve got you covered.

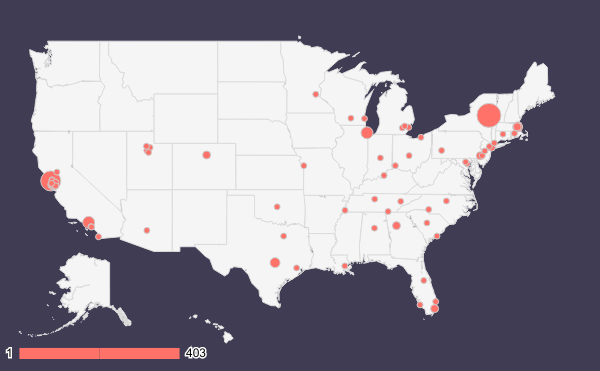

It doesn’t matter what area of expertise you’re looking for. We have investors you should be speaking with.

Top locations:

2021 was crazy. We were able to turn this community into a business, and we were only able to do that because of the support

This post describes 5 rules for great online community hygiene that will create clear community expectations as soon as a member joins.

My entire career has been in venture capital.

I’ve worked as an intern. I’ve worked as a junior VC. I’ve sold software to VCs. I’ve been a community builder for VCs.

Here are 50 honest takeaways from my time in venture.