One of the biggest challenges small business owners face is payroll. Between W-9s, 1099s, tax forms, and the sheer number of people to manage, it’s enough to make even the most fearless entrepreneurs lose sleep at night.

Luckily, there’s a solution that can help—Gusto. Founded in 2013, Gusto aims to solve one of the most complicated parts of business administration-accounting and payroll—with an easy-to-use service that makes sure you have everything covered in one place.

There’s no right or wrong way to handle payroll; whatever works best for your business is what you should go with. As Gusto suggests, automating tasks is a good way to save yourself some headaches. But when it comes down to it, if there’s one thing businesses need help with most in today’s marketplace, it’s time.

There’s no right or wrong way to handle payroll; whatever works best for your business is what you should go with. As Gusto suggests, automating tasks is a good way to save yourself some headaches. But when it comes down to it, if there’s one thing businesses need help with most in today’s marketplace, it’s time.

What Is Gusto?

Gusto is a new way for small businesses in the US to manage payroll. Gusto handles everything, including employee onboarding, insurance, taxes, and reporting. Instead of worrying about forms and deadlines — you’ll pay a small flat fee per month.

They’re designed specifically for business owners who don’t have HR or accounting experience. With Gusto, you get all that expertise without any hassle from your account manager (who does most of their work remotely).

Businesses have full access to the dashboard to manage employee data, whether seeing what an employee is doing right now or changing how paychecks are processed. We help small businesses handle all of their payroll, HR, benefits, and reporting in one place.

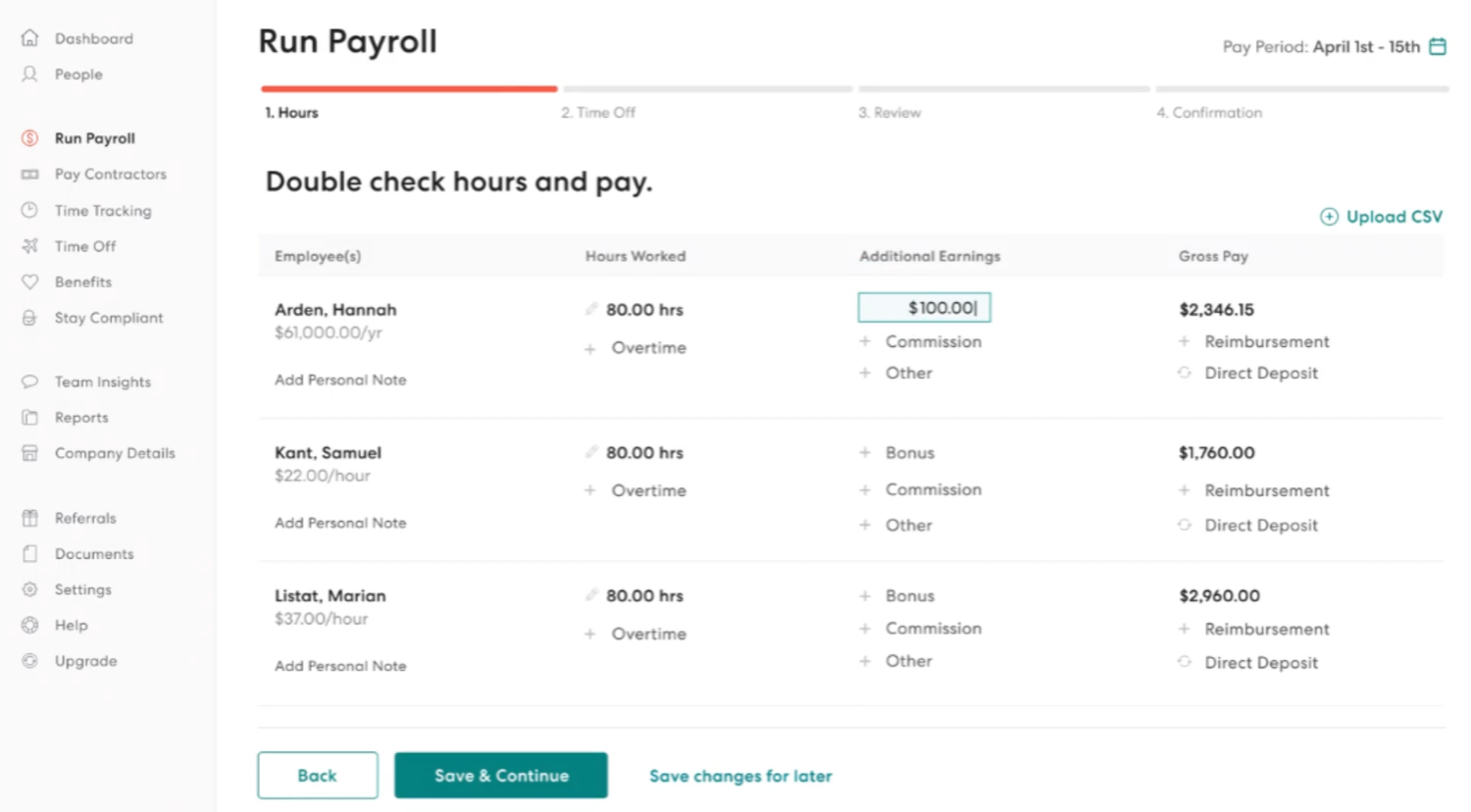

How To Handle Payroll With Gusto

Start by logging into your account. Once there, select a business. Next, choose an employee. Add them as employees to your account by adding their name, social security number, date of birth, and email address. You should also add their gross pay per hour or annual salary—Gusto will even determine how much you need to withhold from each paycheck for taxes.

Lastly, create an access level for each employee so that they only have access to what they need to do their job well—and nothing more. It’s that easy to keep your employees happy while saving yourself time and money on payroll.

For example, if you want an employee to be able to view reports but not make any changes, assign them View Only access. If they need to be able to change hours worked in reports but not run reports themselves, assign them Edit Reports Only access. And if you want someone in HR to see all information related to their department but no other information in your system (like customer data), give them View HR Only access.

Choose from different access levels, such as View Only, Edit Reports Only, or View HR Only. Next to each employee’s name is a letter-based indicator of their access level (e.g., V). When you assign a level for an employee, it will show up in grey text under Access Level (e.g., A). To change or reassign an employee’s access level at any time, click on Access Level under their name. Then choose which new access level you want them to have and click Save Changes.

Make sure you’re up-to-date on tax law changes. Go to your settings menu, select Tax Settings from the left sidebar, then select Filing Taxes under Taxes in Gusto. In Filing Taxes, you can opt into getting your W-2s and 1099s early (or as soon as they are issued), so you don’t have to worry about sending out forms by January 31st. For example, if you get a W-2 in February instead of January—which may be required for some banks or clients—you’ll need more time to send them out and will likely have extra paperwork on hand at year’s end.

What You Need From Each Employee On Their Account

If you’re doing payroll in-house, you need employees (or their representatives) to submit forms like W-4s and I-9s. If you’re using a software solution, your vendor will likely be able to store these forms on file or electronically fill them out for you.

Either way, all forms must be filled out as thoroughly as possible; incomplete or incorrect information could delay your employee paychecks by weeks—which is never good. Even if they think they know what they’re supposed to put down on a form, it may not match up against third-party data sources or state tax agencies. Here are a few things you need from each employee for their Gusto account.

- SSN

- Last Name

- First Name

- Address Line 1

- City

- State Zip Code/Postal Code

- Email Address

- Phone Number

Once you have all these details, you can set up your payroll, taxes, and benefits. Check with your accountant on which of these taxes you’ll need to pay: Social Security (FICA), Federal Income Tax Withholding (FITW), Medicare Tax Withholding (MFW), Federal Unemployment Tax Act (FUTA). How many employees you have, how much they are paid per hour, and their filing status determines how much of each tax you’ll need to pay. If possible, set up your Federal Income Tax Withholding first so that you don’t run into a situation where an employee gets a big tax bill.

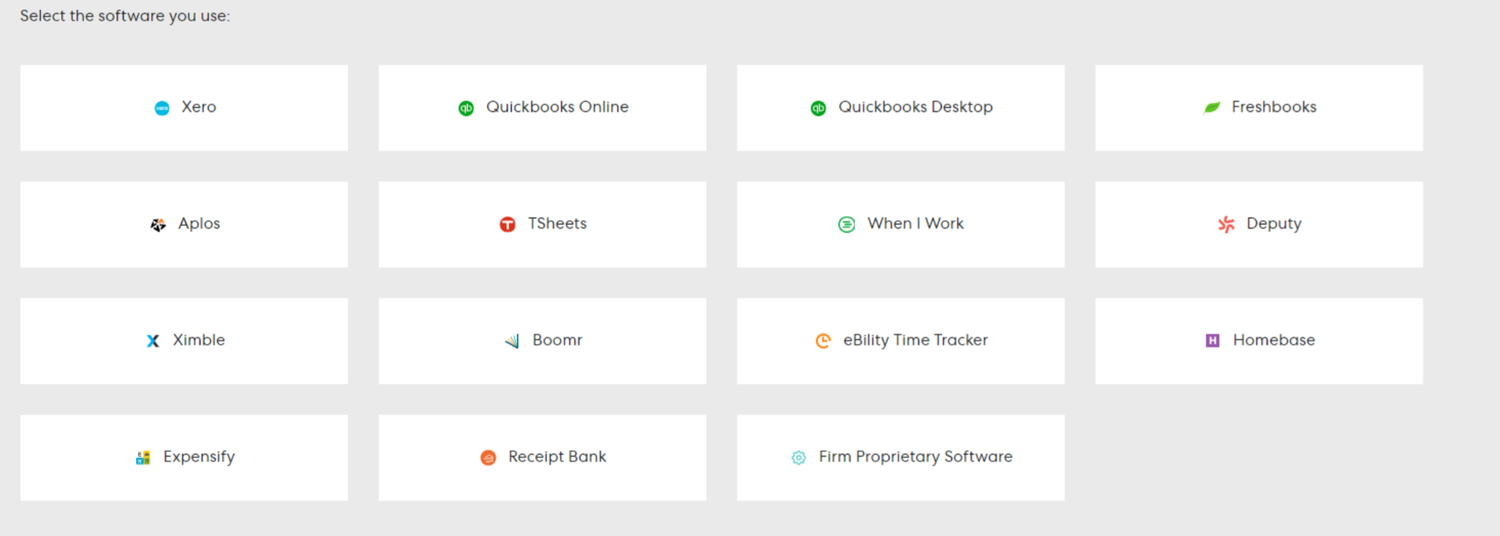

Third-Party Integrations With Gusto

Getting Gusto up and running is free. You can get started in a few different ways: If your company already has existing accounts on QuickBooks, NetSuite, ZenPayroll, or other accounting software, you can integrate them into Gusto. Getting them integrated can take some time, but it’s painless once it’s done.

You sit back and let Gusto do its thing. In most cases, you’ll be able to use existing bank accounts for payroll taxes—meaning you don’t have to go through a lengthy account setup process. This makes payroll easier than ever before—plus, your employees will have access to their pay stubs right away.

And if your company isn’t integrated? There are plenty of apps that can connect almost any piece of software (think programs like ScheduleOnce or Upwork). Other popular third-party apps that can be integrated with Gusto include but are not limited to:

- Asana

- Bonusly

- Boomr

- Bookkeeper360

- Autobooks

- AttendanceBot

- Bitlancer Studio Tools

- Boast R&D Tax App

- Box

- Breezy HR