CFOs are in desperate need of software help.

These workers keep their businesses afloat by managing spend, budgeting, and planning strategic goals for the rest of the business. Like any other job, it’s hard to be effective when you are operating without leverage (doing manual data entry is not a high-ROI activity for anybody), and their is a need for better CFO tools.

In this article, we will cover the best CFO software solutions for payment processing, spend management, HR, and accounting. The goal of this article is for finance leaders to adopt better software and improve their internal workflows.

Here are the cfo software tools we recommend for your finance tech stack.

CFO software is designed to assist CFOs and teams with various financial management tasks. For instance, typical solutions include:

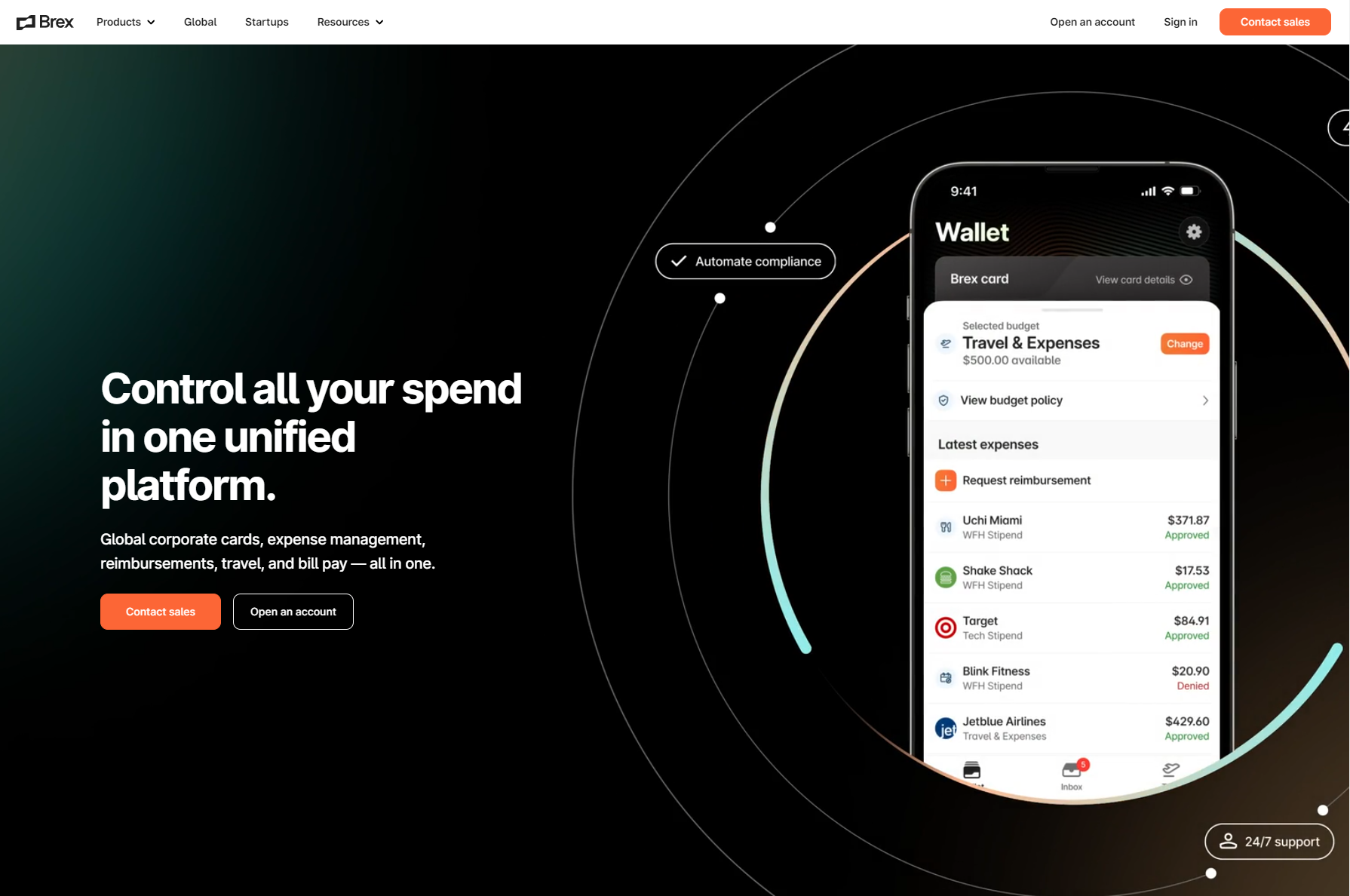

Brex is an American financial service that helps you control all spending from a single unified platform.

You can use Brex to manage global corporate cards, reimbursements, travel, expenses, and pay bills. Because this platform allows you to unify several features and functionalities, we recommend it to future-proof the way your business manages spend.

Brex cards have no user fees (the company earns its money through interchange fees, which are paid by the merchants). However, in order to be eligible, you will need more than $1 million in revenue and be based in the United States.

Read more: Brex Review: Requirements, Features, Pros and Cons, Plus 50k Free Signups Points

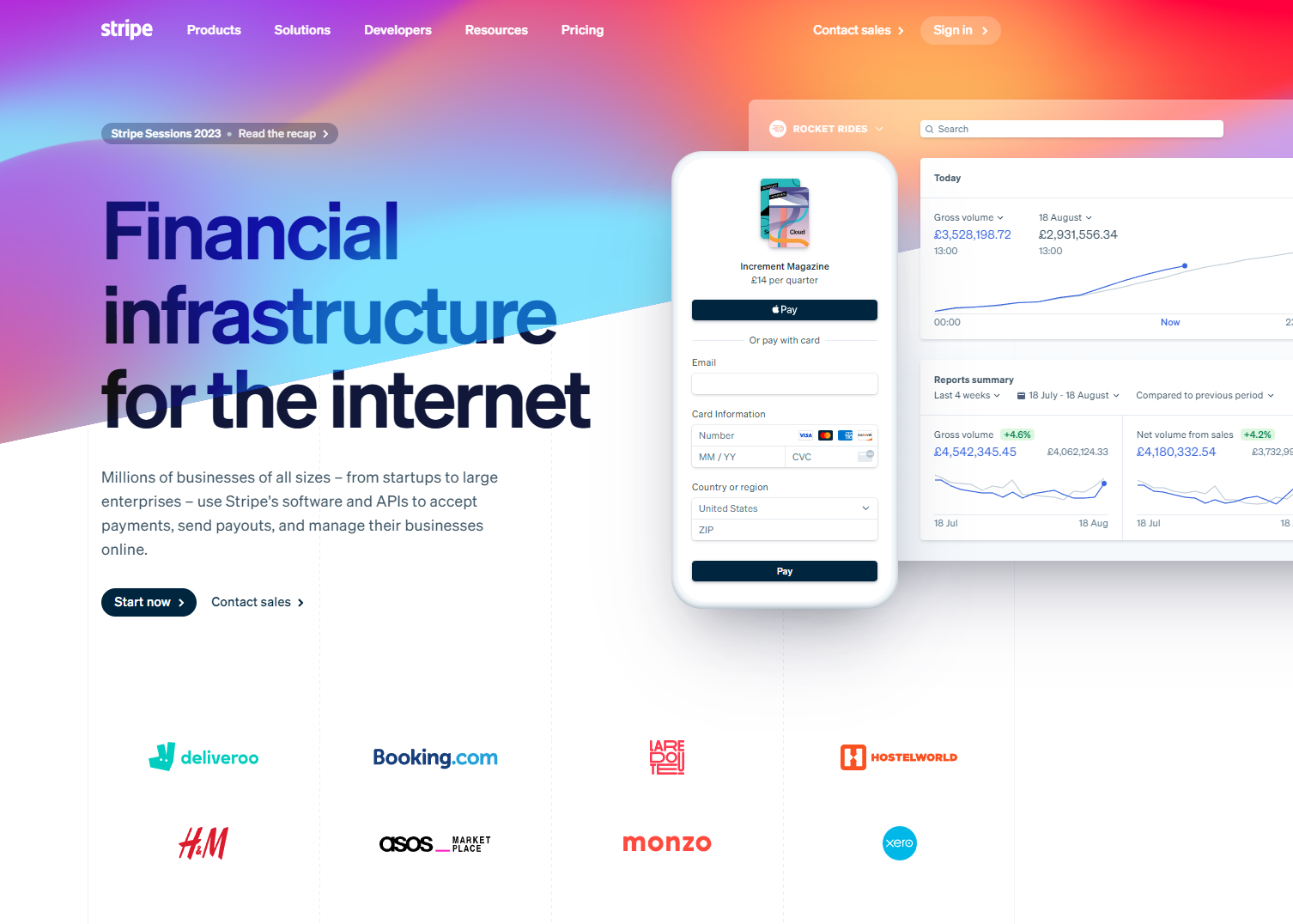

Stripe is a financial software solution that allows you to accept payments, send payouts, and beat fraud.

Stripe’s fully integrated product suite is designed for online and in-person retailers, software platforms, subscription businesses, and marketplaces and brings together everything you require to build websites and apps that can take and send payments. Plus, the solution can also help you issue virtual and physical cards, get financing, and manage your business spending.

Manage your business online: Send invoices, accept payments, and issue virtual and physical cards. Pay third parties and issue vendor payouts.

Financing: Embed financial services (including lending, cards, and accounts) and manage business spending. Earn, store, and move money quickly and without leaving the platform.

Advanced features: Integrate with APIs, use AI tools and machine learning models, and support 3D secure authentication.

Stripe charges 2.9% + 30 cents per successful card charge. Bank debits and transfers are free, and additional payment methods start at 80 cents.

GoCardless supports secure and simple direct bank transactions to help you collect one-time or recurring payments.

In other words, this platform makes it easier for your customers to pay you, automating reconciliation without the need for any card fees. One of the main advantages of GoCardless is that you will be able to see the status of any payment, from any customer, at any time.

Payments: Support instant, one-off payments. Automate all admin and move money directly from your customer’s bank to yours. Produce invoices for services and collect payments from +30 countries.

Recurring subscriptions: Allow subscriptions, fees, and installments and generate automatic retries.

Integrations: Integrate with 350+ systems, including Kashflow, Sage, Xero, Clearbooks, and more.

GoCardless has no setup costs and no contracts. You just pay 1% + $0.25 per transaction for the USA (there’s an additional 0.3% for transactions above $1,000) and 2% + $0.25 for international payments (currency conversion is included).

Gusto is an award-winning payroll management solution that lets you handle hiring, benefits, and bookkeeping no matter where you or your employees are.

This cfo software can help your finance teams file taxes, comply with regulations, and identify hidden tax credits. Additionally, you can use Gusto to do workforce and project costing and generate actionable team insights and custom reports.

Full-service payroll: Do unlimited payroll runs and pay contractors automatically. Review and approve time off, run feedback surveys, and stay compliant with registrations.

Accounting and bookkeeping: Report and monitor projects and costs and deal with state tax registration. Get R&D tax credits and calculate workforce and project costs quickly.

Automatic reports: Access actionable team insights from any device and create automatic custom reports for all aspects of your business.

Gusto offers two main plans. The Simple plan costs $40 a month + $6/mo per person and includes the main automatic payroll features. The Plus plan costs $80 a month + $12/mo per person and adds advanced tools and full support.

Read more: Gusto Review: Our Full Breakdown on Our Favorite Payroll Tool Plus 9 Tools to Level Up Your HR Team

Deel is a payroll and compliance software tool that allows you to pay your teams, streamline offers and onboarding, and avoid fines.

Deel also makes it easier to manage your entire global team, from people data, time off, expenses, and reporting, all from a single location. Plus, the platform supports inclusive benefits, offer letters, and has excellent onboarding capabilities.

Large feature suite: Access 16 different HR tools in one tech stack, including bulk pay, autmated contract invoicing, taxes, payslips, legal and tax, and more than 15 global payment options.

Payroll and benefits: Handle benefits, and equity, hire and relocate team members easily, and send equipment worldwide.

Compliance and efficiency: Create compliant contracts and eliminate errors and duplicated work.

Deel has a fee plan for direct employees and two paid plans. Deel for contractors starts at $49 monthly and focuses on the best remote experience. Deel for employers starts at $599 and handles everything for you.

Workday is an on-demand financial planning and financial management cfo software tool that uses the power of AI to help you make decisions faster.

This platform features an adaptive architecture that promises to keep up with the changing demands of the industry, helping you make decisions faster and empowering finance teams at every level.

Intelligent automation: Optimize your processes with connected systems built for performance. Standardize processes and compliance and utilize embedded AI for maximum efficiency.

More control over your processes: Access always-on-auditing, gain visibility across geographies, and support complex revenue arrangements.

Reporting and insights: Create close and consolidate custom reports and access real-time insights to help you make better decisions.

Workday offers quarterly or annual subscriptions. The software fees start at about $45 a month PEPM, and there is a minimum annual cost of around $275K.

Carta is a capitalization table management and valuation solution specializing in equity management, compensation, venture capital, and liquidity.

Built ‘for builders’, Carta can help founders, investors, and financiers keep moving forward.

One-stop infrastructure: Manage all your equity from a single place, explore cap tables and valuations, and handle expense accounting all from the same location.

Fundraising tools: Plan and organize fundraising and issue shares, plan equity, and easily communicate with stakeholders.

AI support: Use machine learning to compensate, manage reports, and receive automatic cap table updates.

Carta has three plans, all of which you can try through a demo.

The prices vary a lot, but there is a Build plan focused on end-to-end fundraising tools and equity management, a Grow plan for valuations and reporting, and a Salce plan for compliance and expense management. The average cost is about $2,500 a year. Carta also offers add-on products like liquidity and tax advice.

Pulley is a top-rated cap table solution to help you issue and track equity.

This easy-to-use software has helped thousands of startups with tools and advice from seed to scale. You can use Pulley to manage employees, investors, and your HR, finance, and legal teams. All their costs are transparent and predictable, no matter the plan you choose.

Issue and track equity: Manage the entire fundraising process, apply for equity grants, and send easy updates to investors.

Compliance and security: Put your equity compliance validations in auto-pilot, produce stock-based comp reports, and reduce workflow errors.

Crypto and tokens: Pulley supports token valuations, and variable tax withholdings and works with payroll providers and custodians to stay compliant while issuing and distributing tokens.

Pulley has three plans.

There is a Seed plan, which is free for 25 stakeholders, a Startup plan ($1,200 a year), which includes a communications hub, and a Growth plan ($3,500 a year) that adds valuations, rules and forms, board approvals, and more. If you are an early-stage startup, you can also ask for a special crowdfunding price.

Shareworks is a cloud-based equity compensation administration platform and comprehensive workplace financial solution that allows users to share, comly, collaborate, model, and trade. The solution is part of Morgan Stanley at Work’s Suite and also provides support for attracting and retaining top talent.

Equity compensation: Manage equity compensation, issue digital and hybrid shares, and get automatic 409A valuations.

Reports and monitoring: Easily model term sheets and forecast scenarios and share reports in real-time.

Expert advice: Connect with equity compensation specialists directly from the platform.

Shareworks does not share its pricing. You will have to book a demo and talk to their sales representatives to learn more about getting a solution that fits your business.

Quickbooks is an accounting software solution developed by Intuit.

This platform allows you to automatically track income and expenses, integrate payroll, track time, and accept credit cards. Quickbooks gives you a very clear view of your earning and spending and can manage your books for you, reason why it’s become quite a popular choice for managing financial data.

Sending payments: Handle payroll and payroll taxes and track, adjust, and approve your team’s hours.

Receiving payments: Take payments online, by card, ACH, eCheck, and others, and auto-track expenses and deductions.

Integrations and reports: Integrate with several apps and tools (including Amazon and Bill.com) and create enhanced reports.

Quickbooks offers three plans.

The Simple Start plan costs $15 a month and includes basic but effective functionality. The Essentials plan costs $27.50 a month and adds sales channels and bill management. And the Plus plan costs $42.50 a month and includes more users, inventory, and project profitability tools.

Xero is a cloud-based accounting software designed to help small and medium-sized businesses with all their accounting needs.

This solution includes tools to pay bills, claim expenses, send invoices, connect with banks, accept payments, track projects, and a lot more. With over 3.5 million subscribers and a Trustpilot rating of “Great”, Xero is a finance tool that can help your company save time and effort.

Accounting tools: Track and pay bills, explore cash flow and manage spending and submit expense claims, and capture bills and receipts automatically.

Banks and payments: Connect to and set up various bank feeds and accept payments through Stripe, GoCardless, and others.

Communication and sharing: Track project progress (including costs and profitability) and manage and share documents easily.

Xero has three plans, all of which cover accounting essentials.

The Early plan costs $13 a month and is good for traders, self-employed people, and new businesses. The Growing plan costs $37 a month and is better suited for small businesses. And the Established plan costs $70 a month and is great for established businesses. You can try all plans for free.

We have covered some of the best enterprise resource planning systems, accounting software, and finance tech stack for CFOs.

Here is one additional tool if a 409A valuation is needed for your company.

If you’re looking for an enterprise-grade platform to handle financial planning, data analysis, financial reporting, and access to all the payment processing tools your business requires, we recommend Brex, as it offers an excellent balance of enterprise-grade automation, security, and integration, including the ability to manage global corporate cards, expenses, travel, and bills.